How to Start an LLC Explained By an Attorney

How to Start an LLC Explained By an Attorney

A Limited Liability Company, more commonly known as an LLC, is a legal business structure that combines certain elements of a sole proprietorship or partnership with a corporation. Starting an LLC offers many advantages and the process is not that complicated once you know the steps. This article discusses how entrepreneurs can start their LLCs, detailing some facts you need to know before starting the process.

Starting an LLC is one of an entrepreneur's smartest moves to protect their business and personal assets. But for many, the process feels confusing.

In this guide, we'll help you understand the process of starting an LLC, break down the benefits, and discuss some facts you need to keep in mind.

Why Should You Start an LLC?

Starting an LLC (Limited Liability Company) provides legal and financial protection for your business.

When you learn how to start an LLC, you receive several benefits that make it an attractive business structure:

- Your personal assets remain protected from business debts and lawsuits

- You'll gain tax flexibility with options for how your business is taxed

- You can build credibility with customers and vendors

- Your business name receives legal protection

You don't need a board of directors or shareholders, and you can run your business as a single-member LLC or with multiple partners. This business format works well for both small and growing companies.

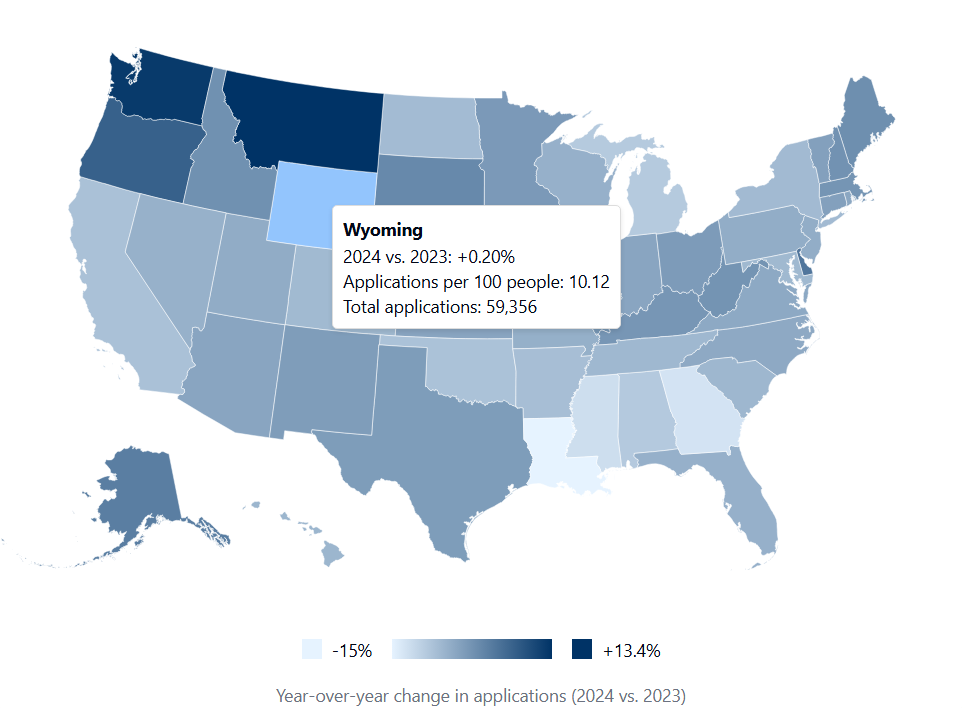

What's the Best State to Start an LLC?

Most local businesses, such as store owners or tradespeople, will want to start an LLC in the state where they work. However, if you run an online business or don’t live in the U.S., choosing your state more carefully is likely beneficial.

It’s best to seek the advice of a tax professional, as everyone’s situation is different. But, states such as Wyoming and Delaware have become hugely popular in recent years. In fact, Wyoming has more business applications per capita than any other state in the U.S.

This is down to a few reasons:

- Zero state income tax means you get to keep more of your money.

- Strong privacy protection laws: When you use a registered agent service, you can form an anonymous LLC. Wyoming never publishes your personal information on public databases like other states.

- Low filing fees and annual costs: A Wyoming LLC costs just $100 to form and $60 to maintain.

- Minimal reporting requirements: An annual report takes a few minutes to complete and can be done online.

To form an LLC in Wyoming, you’ll need a Wyoming address. A Wyoming virtual office is a good legal workaround for this as long as you choose a quality service that can provide lease agreements and utility bills. The virtual address must be a legitimate address, not a P.O. box.

Make Sure You Choose a Quality Address

The number one mistake entrepreneurs make is choosing a low-quality address for their LLC. For states that don’t require your personal information, you’ll use a service to provide you with an address for your LLC.

I have seen addresses that are shared by 100K+ businesses. While there isn’t anything technically wrong with this, it can cause your LLC problems with business banking.

These addresses (usually the cheapest) will be posted on the internet and used by scammers, which means it’s only a matter of time before the USPS flags them. Banks and any services that require KYC checks use the USPS to determine whether an address is legitimate or not.

If your LLC needs business banking, you’ll need to use an address that provides lease agreements and utility bills. Some virtual offices can provide this, and some won’t. These documents are required to open a business bank account.

Choose a Unique Business Name

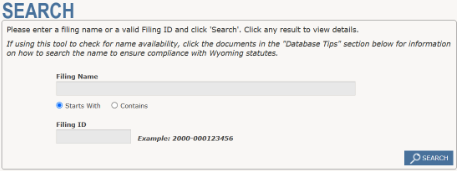

Your LLC’s name needs to be unique and distinguishable from other registered businesses in your state. Before you get attached to a name, check your state’s business database to see if it’s available. Most states won’t approve a name that is too similar to an existing one.

Your LLC’s name must include a legal identifier, such as “Limited Liability Company,” “LLC,” or “L.L.C.” Some states have additional naming rules, like restrictions on certain words. For example, terms like “Bank,” “Attorney,” or “Insurance” may require special approval.

It’s also a good idea to check for trademarks. A trademarked name could lead to legal issues even if your name is available in your state. The U.S. Patent and Trademark Office (USPTO) has an online search tool to help with this.

If you’re not ready to register but want to secure a name, many states allow name reservations for a small fee. This holds the name for a set period, usually 30 to 120 days.

Appoint a Registered Agent

One of your first requirements is appointing a registered agent. This agent serves as your company's official point of contact for legal documents and must have a physical street address in the state of your incorporation.

The exact requirements for a registered agent vary by state, but typically, your registered agent must be:

- Over 18 years old

- Available at the specified address during regular business hours

- Able to receive legal notices and official mail

- Willing to forward important documents to you promptly

You can serve as your own registered agent, but it’s not something I would recommend. I’ve seen cases where service papers get lost with assistants, leading to even more problems.

Professional registered agent services offer advantages like more privacy and reliability. Many services also provide compliance reminders to keep your LLC in good standing.

File a BOI Report

The Beneficial Ownership Information (BOI) reporting requirement affects all LLCs.

You'll need to file your BOI report with FinCEN within 30 days of your LLC's formation. This report must include information about your company's beneficial owners. This is required for every state in the U.S.

Key documents you'll need to submit:

- Full legal names of all beneficial owners

- Date of birth for each owner

- Current residential address

- Image of the ID document

You're required to update your BOI report within 30 days if any information changes. Everything can be filed online through FinCEN easily and for free.

Do You Need an Operating Agreement?

Operating agreements aren't legally required in most states, but they are considered good business practices. I know it can be exciting to get started when you form an LLC, but an operating agreement can help protect your business. Add it to your checklist of things to do so you don’t forget.

An operating agreement outlines how your business will operate and handle important decisions. It’s more necessary for multi-member LLCs than single-member LLCs.

Your operating agreement should include:

- Ownership percentages for each member

- Distribution of profits and losses

- Management structure

- Rules for adding or removing members

- Procedures for dissolving the LLC

Create an operating agreement that's specific to your business needs and circumstances. You can work with an attorney to draft one or use online templates as a starting point.

Before finalizing the agreement, ensure that all members review and sign it. Keep this document with your other important business records and update it when major changes occur in your LLC.

Applying for an EIN

A federal Employer Identification Number (EIN) is used to hire employees and file taxes. You can obtain your EIN by applying through the IRS website at no cost.

If you have an SSN, you can apply for an EIN online. The process is simple and easy. However, if you’re not a U.S. citizen, you’ll have to apply for an EIN by phone, fax, or snail mail.

Start Your Business Securely Today

Starting an LLC is a smart investment in your business future. By creating this legal structure, you're not just forming a company, you're building a shield that protects your personal assets.

The process might seem intimidating at first, but it's manageable when broken down into key steps. Follow what’s listed in this article, choose quality providers, and your business will be up and running in no time.