How to Make Your Mobile App Revolutionary in the Banking and Finance Sector

How to Make Your Mobile App Revolutionary in the Banking and Finance Sector

Contributed ContentBanking and financial apps can offer their users a variety of services. Making your application stand out from the crowd is key to a successful product. Look beyond checking your bank account and find what other ways these apps can be beneficial.

The days of pushing forward in long bank lines waiting for cash withdrawals and transactions are gone. In the technology-driven era, mobile apps have become part of our daily lives.

Be it a social media app, a fitness app or even a mobile banking app, mobile apps have been ruling the technological circuit currently.

Have you ever caught yourself into a situation where you want to make a quick transaction or you wanted to keep a check on your bank balance? If the answer is yes, then mobile banking apps are the perfect solution for you to keep an eye on your bank account even in the vicinity of your home.

There are many banking software companies that have been providing financial services in the form of mobile banking apps that you can utilize for your banking operations.

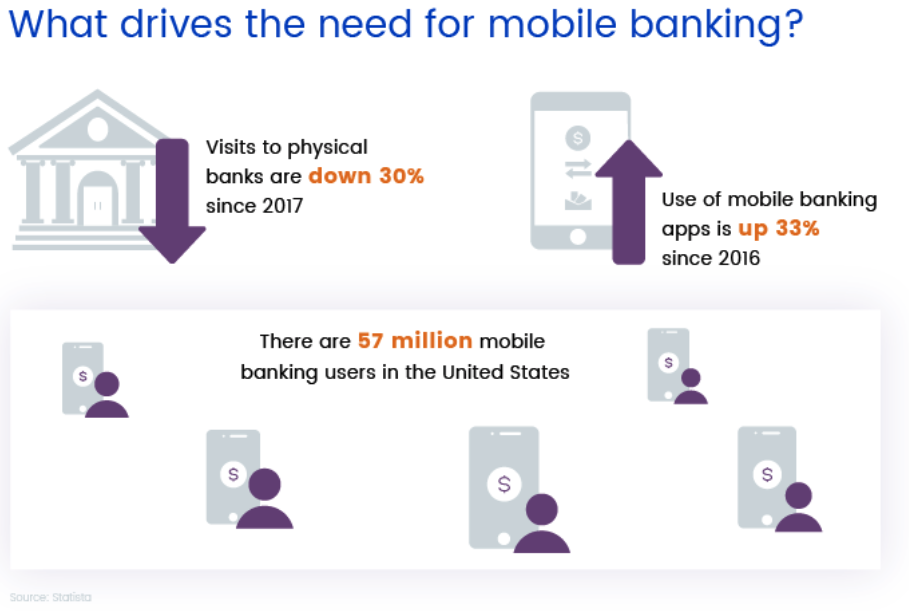

The exponential and tremendous growth in the number of mobile users in the past few years has gradually led to the increasing popularity of mobile banking apps. Since 2018, the use of mobile banking has increased up to 33%.

Source: serviceonemarketing.com

In the United States, there are 57 million mobile banking users. By 2019, approximately 2 billion users will have these type of applications.

It’s been estimated that with the influx of mobile users, a rise in the potential userbase can be seen for mobile banking apps. The rise can be seen in the growth revenue cycle for the banking and finance industries.

With the inclusion of high-end banking mobile apps, there’s a great scope for financial software companies to revolutionize and revamp the growth revenue cycle.

The Rise of Mobile Payments and Mobile Wallet Apps

Mobile phone users don’t necessarily carry a physical wallet to make a purchase. They can easily make a transaction through their smartphones via mobile wallets. There are plenty of options that are available in the App Store that can simplify the way you look at mobile payments.

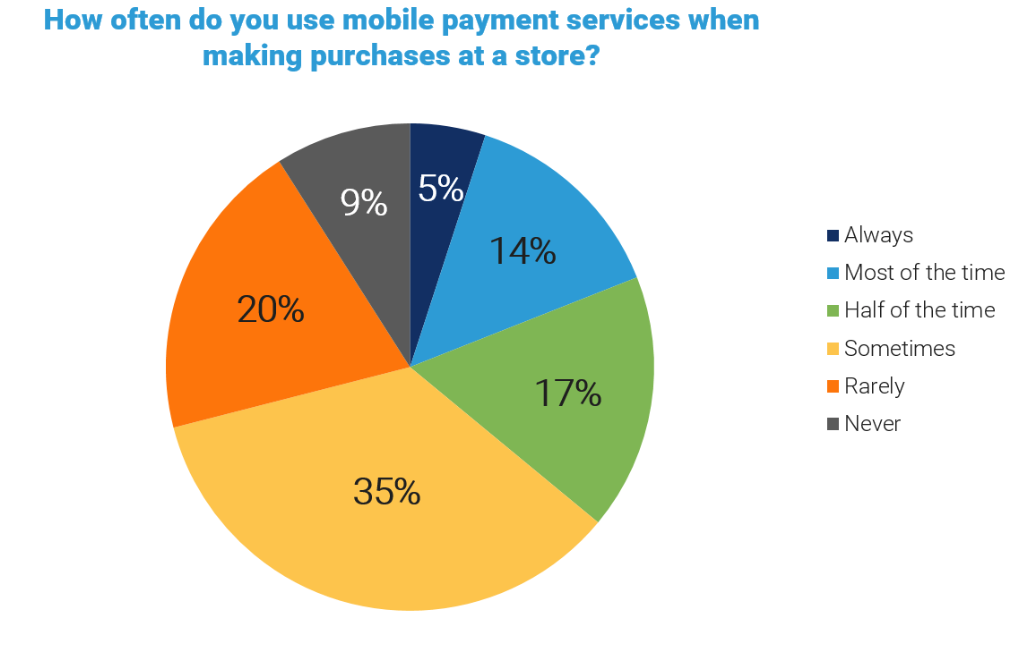

According to the latest data from the 2019 National Technology Readiness Survey by Rockbridge Associates, over four in ten (41%) smartphone users currently use a mobile payment service such as ApplePay or AndroidPay. The percentage of mobile payment users has doubled since 2016 (21%).

The use of mobile payment services by consumers has grown rapidly in the past few years, which can benefit both consumers and businesses. About 60% of users have PayPal as their smartphone’s payment service.

Mobile payment services are efficient that can help in the quickest, most convenient, and securest way. The advancement of mobile payment systems will likely increase the usage and frequency of mobile app users if businesses are willing to expand their capacity.

When it comes to making purchases in stores, only 5% of consumers use mobile payment services. It’s inevitable that digital wallets are continuing to soar in popularity.

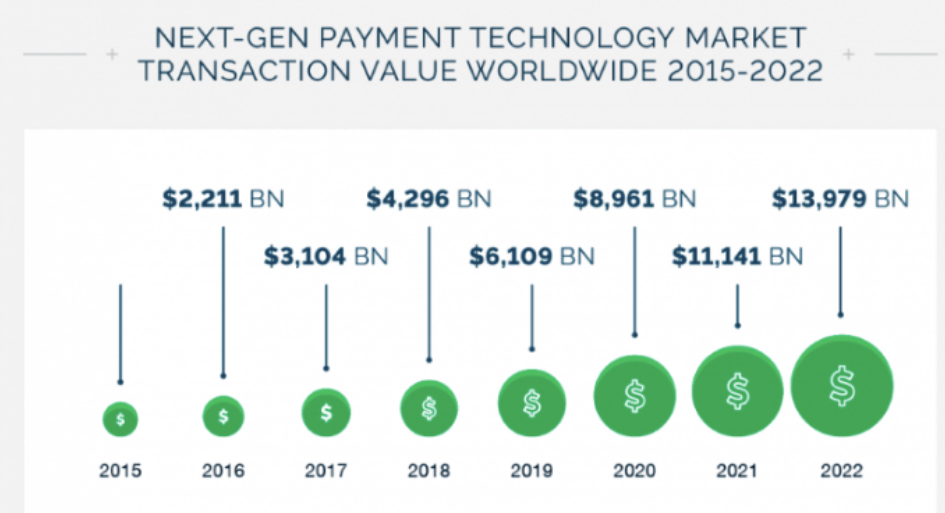

There has been an estimation about the frequent shift in the Next-Gen Payment Technology Market Valuation for the business year 2015-2022. In 2017, the estimation was expected to reach $3.1 trillion.

The image below represents the stats about mobile wallet users for the coming years. In 2020, the value is expected to reach over $8 billion.

In 2022, it’s expected to hit over $13 billion, which seems likely due to the next innovations hitting the financial app sector.

6 Techniques to Make Your Mobile App a Staple in the Financial Sector

- Reduce operational costs

- Adding simple and secure sign-in

- Customizing user experience

- Creating an intuitive user interface

- Payment through QR codes

- Validating voice payments

1. Reduce Operational Costs

The use of mobile apps has also ensured that the operational cost of running a business can be reduced. Mobile banking apps provide the one-stop solution for all your personalized banking services such as transactions, cash deposit, and withdrawal and much more.

Apart from this, banking apps also ensure that there is a seamless transfer of data from the customer to management and vice versa. Mobile banking apps have made a space for virtual customer help stations and have reduced costs further.

There are some common apps that are available in the market for your financial services. Expensify is an app geared toward providing a guide to managing expenses. Another top-rated app is Mint, an app that allows multiple credit cards along with the ability to view your monthly expenses and account balances.

The most well-known is likely PayPal. It’s an easier and faster way to make transactions. It’s also widely accepted in over 200 countries, allowing the system to be trusted by over 250 million customers. While being free for iOS and Android, the app directly connects to accounts and keeps track of payments.

2. Adding Simple and Secure Sign-In

Security has been the topmost concern of a mobile app. Multi-factor authentication is secure but time-consuming. It irritates most of the users as to when compared to authentication based on biometric data.

But with the emergence of mobile apps, the sign-in has become simpler and secure for mobile wallet apps or mobile payment services through efficient security protocols and transmission services.

3. Customizing User Experience

With the increase in mobile banking applications, there is an increase in the revenue cycle for banking institutions or companies providing banking and financial services.

Through better usability and functionality, the engagement of the users towards banking & financial industries is bound to increase.

With a great count of digital users, banking & financial industries are majorly judged by its application services. Hence a robust and feature-rich mobile banking application can add up to the trust and reliability of the consumers into mobile banking services or apps.

4. Creating an Intuitive User Interface

Using a PIN or having a user-friendly interface allows simpler access to bank accounts. It’s become more favorable amongst consumers as well.

Only with a few clicks, users can transact money instantly. You can pay for your bills without much of a hassle.

5. Payment Through QR Codes

Scanning QR codes directly from your mobile banking app is an efficient, fast and convenient method of paying for good services. Consumers need to scan the QR code from their smartphones to enable payments.

QR codes are certainly not the next big thing in the technological advent space.

However, there are only a few mobile banking apps that can execute and implement QR code scanned payments.

For example, Dutch banks, ING and Rabobank, were among the first with their mobile app Payconiq, released in January 2018. It simplifies online and in-store payments with the help of a QR scanner built within the app.

6. Validating Voice Payments

With the emergence of a technology-driven era, there is a possibility and space for innovation in the mobile banking space. Voice payments being one of them.

Now, in this scenario, you can validate your payments through voice banking. Voice banking is gradually finding its way into the banking sector, bringing immense benefits for customers.

The Royal Bank of Canada and Barclays are the early adopters of voice technology. Apart from security concerns, this change can bring a new revolution in terms of accessibility.

The Future of Mobile Banking Apps Promotes Innovation

The advancement in mobile banking apps can be a win-win situation for both the consumers and banking and finance industries.

The mobile banking app can simplify the complex process of banking industries thereby increasing the customer's response and involvement in the app.

The future of banking and finance industries goes hand in hand with the latest mobile application development trends. Mobile banking apps have made our lives easier by empowering us to accomplish our critical tasks related to funds and finance hassle-free.

There are many finance software development companies who can help you out with integrating the mobile banking app within your existing banking and finance industry ecosystem.