8 Financial Resources for New Businesses

8 Financial Resources for New Businesses

Contributed ContentNew businesses are likely to face financial issues, whether it’s low cash, inefficient accounting methods, or lack of knowledge. These eight financial management resources can help small businesses get off the ground financially.

Updated April 17, 2023

If you’re a new business owner, you’re probably getting a crash course in cash flow. The economics of making any business work are tricky, and you’ll need to make adjustments to your business plan on the fly to stay in the black each month.

In this struggle, you’re not alone. Running out of cash is one of the top reasons why small businesses fail. And even if your cash flow is solid, there are a variety of financial issues that will continue to crop up throughout the life of your business, from not having enough capital to scale to inefficient accounting methods.

So, what’s a business owner to do? As your business gets off the ground, you need to start rallying all the best financial resources possible to your side. There’s no need for you to go it alone.

From tools to funding to the latest in automated software, these are the eight best financial resources for new businesses.

Browse our list of financial service providers on The Manifest

Top 8 Financial Resources for New Businesses

Browse through the following financial planning resources to help your business stay accountable

- Dedicated business checking accounts

- 0% APR business credit card

- Short-term financing options

- Microloans

- Grants

- Automated accounting software

- Point of sale software

- Mentors in your field

1. Dedicated Business Checking Accounts

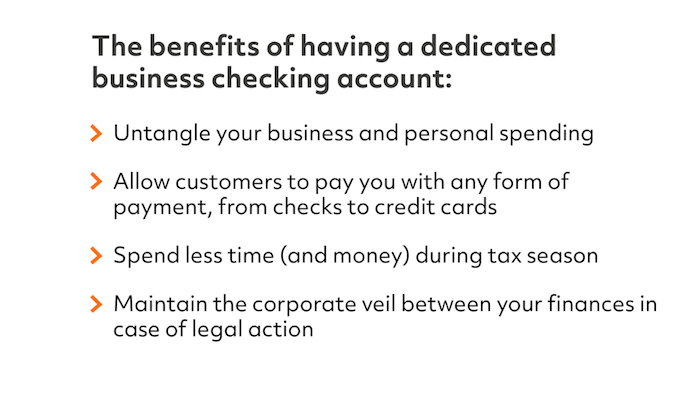

New business owners, particularly “solopreneurs” and sole proprietors, have a tendency to run their business finances through their personal accounts. According to a survey by TD Bank, 27% of business owners use the same checking account for personal and business dealings. Businesses should have their own bank accounts for financial assets.

This is the wrong move for a number of reasons. From a cash flow perspective, you’ll find it difficult to separate your expenses and get a clear picture of your business’s income. You’ll be less likely to “borrow” from yourself to make ends meet. And during tax season, you’ll be able to run reports and generate tax forms without having to parse out personal expenses first.

Source: Fundera

There are also legal ramifications for not separating your business and personal finances. Keeping all your money in one account pierces the “corporate veil” and can make you personally liable if someone takes legal action against your business.

Keep your personal finances safe, and move your business finances to a free business checking account — you have many options for financial institutions and bank account types in this space.

2. 0% APR Business Credit Card

A business credit card is another tool that many people overlook in favor of their own personal credit card. Some people want to rack up the points on their personal credit card, while others might not know there’s a difference between the two products. Just like having separate bank accounts to keep business and personal bank deposits aligned, with a separate business credit card, financial statements will be clear and easy to follow.

The benefits that business credit cards afford business owners are too good to pass up. One perk in particular that is worth exploring is a card with a 0% introductory APR (annual percentage rate), which sometimes lasts up to a year.

These business credit cards require the owner to have good credit, but if you qualify, a year without accruing interest payments on any of your purchases is an incredible tool at your disposal. You can make major investments in equipment and/or inventory, and you’ll have time to let those investments pay for themselves before you owe a dime in interest.

Some 0% introductory APR cards also allow you to conduct balance transfers, bringing existing debt from another credit card over so you can begin to pay it off without racking up more interest payments.

Keep in mind that once your introductory offer is up, your APR will set in at a rate that depends on your creditworthiness and the market prime rate. Check the issuer’s terms and conditions for the latest APR information and repayment options before signing up.

3. Short-Term Financing Options

Many businesses, at one point or another, seek some form of third-party financing or funding sources for their business. That could be a bank loan, an SBA loan, or a credit card or merchant cash advance, depending on what they qualify for.

New businesses will have a hard time finding an affordable long-term loan because most lenders want to see at least two years’ time in business before they extend you financing. Lenders do this to ensure there is an incentive for them to invest and that there is less liability.

There are, however, some short-term financing options that are available to new businesses, which may be the perfect solution for plugging a temporary cash flow gap. They include:

- Invoice financing: Waiting for a client to pay an invoice? You can borrow against that outstanding sum, using the invoice itself as collateral.

- Equipment financing: Need to replace or implement a piece of machinery? You can borrow the exact amount you’ll need to make the investment from an equipment financier.

- Inventory financing: Similar to equipment financing, if you find a great deal on inventory and can’t wait to scrounge up the capital necessary, an inventory financier can front you the amount you need to make that purchase.

Businesses shouldn’t hesitate using short-term financing options.

4. Microloans

Another financing option worth exploring is a microloan. These are typically small, short-term loans that are best for businesses that need less than $50,000 to help build out, improve, or scale their operations. You can typically use microloans as working capital, to purchase inventory or supplies, invest in equipment, and more.

Many (though not all) microloans come via nonprofit lenders and are aimed at entrepreneurs from underserved populations such as minorities, women, and veterans.

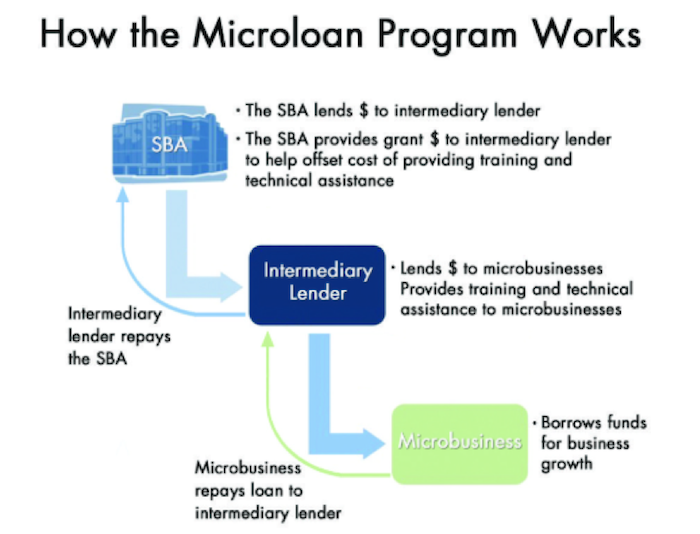

Perhaps the best-known microloan product comes via the Small Business Administration. Alongside its long-term loans, the SBA works with intermediary lenders to extend up to $50,000 to new businesses, to be repaid over a term of up to six years.

Source: WPFSI

Though the SBA Microloan is one of the most sought-after microloan products, it’s not your only option. You can apply for a microloan through organizations such as LiftFund, Kiva, Grameen America, as well as PayPal’s Working Capital.

5. Grants

Another important financing option to consider is a small business grant — because what’s better than free money?

A number of public and private organizations offer qualifying small businesses the opportunity to obtain a startup grant that will help the business owner establish their company, manage financial resources, and get things off the ground.

There are hundreds of possibilities, though keep in mind that most grants are competitive and will require putting in a substantial amount of time and resources into applying and presenting a case for your business. You may need to apply for quite a few grants — but the payoff of interest-free money is worth the effort.

6. Automated Accounting Software

Unless you started an accounting business, there are few tasks you’ll enjoy less than doing accounting. Without keeping track of your finances, however, you don’t have a business; you have a hobby.

These days, you can automate most of the accounting processes you need to perform on a regular basis thanks to software from companies such as QuickBooks, FreshBooks, and Wave. Depending on which you choose, your accounting solution can handle all your basic bookkeeping and accounting, as well as send invoices, track inventory, sync transactions across all your platforms, and more.

Having an actual accountant on staff or at your disposal is an invaluable investment when it comes to making major financial decisions about your business. When it comes to running reports or making sure a client pays what they owe you: These days, software can do that for you — automatically.

7. Point of Sale Software (and Hardware)

In this day and age, plastic — not cash — is king. New businesses, whether they operate online or have a brick-and-mortar presence, will need to be able to accept credit or debit cards as payment.

According to one study, only 14% of consumers prefer to use cash when making a purchase. So, if you want to appeal to a majority of your buyers (though this depends on exactly what kind of business you run and where you’re located), you’ll need to use a modern point of sale (POS) system to take their money.

A variety of POS systems now exist to help you process payments, whether in-person or online. Some POS services also come with extra benefits such as loyalty programs and inventory management software. These additions help you manage your wares, promote your business to high-value customers, and keep better track of your finances on a day-to-day basis.

8. Mentors in Your Field

This final resource isn’t exactly a financial resource, per se — but there are major financial benefits to finding a mentor who understands your field.

A business mentor can help you navigate the logistics and bureaucracy of getting your business up and running, as well as advise you on the best course to take when facing a financial fork in the road.

According to a study by Kabbage, an incredible 92% of small businesses agree that their mentors have a direct impact on growth and the survival of their business. To have a mentor, therefore, is to be financially responsible.

Interestingly, that same Kaggage study reported that 89% of small business owners who don’t have a mentor wish they did. If you’re in that group, consider using a service such as SCORE, or more niche agencies such as the Veterans Business Outreach Center or the Minority Business Development Agency.

Your leg up on the competition through advice from a seasoned small business owner is just a few clicks away.

Better Your New Business With Financial Resources

Almost all of the above financial resources are well within your reach as a new business owner.

If you take the time to explore some of these options, whether it’s applying for a certain form of financing, investing in modern software or hardware options, or reaching out to an industry peer, the ability to empower your business is in your hands.