Benefits of Using Qualitative Research in Business Plans

Benefits of Using Qualitative Research in Business Plans

Contributed ContentAre you a new startup trying to write a business plan without historical data? Based on our experience at Designli, an app design studio that focuses on serving entrepreneurs and startup-minded businesses, this article discusses what we’ve learned about how to conduct interviews, focus groups, and observations to provide the insights you need to create a sound and robust business plan.

Standard business plans typically don't cut it for startups because they're, by nature, based on guesswork. For a startup with no historical data to refer to, the solution is to conduct qualitative market research in the form of interviews, focus groups, and observations that give you the insights you need.

We’re startup founders ourselves, and we work with many startups in our current business. This experience has helped us understand the unique needs and challenges of startups to gather data not readily available to support business planning.

In this how-to guide, we share what we’ve found to be a reliable process for gathering the research data required for building a better business plan.

Why You Need Qualitative Market Research

Market research is critical for every business and especially so for startups that don’t have in-house data from current customers.

Market research provides a foundation for your business and can assist with making decisions and can help you:

- Understand your target market, including their needs, wants, and pain points

- Find and validate growth opportunities for your business

- Identify and respond to market shifts

- Make decisions and mitigate risk

- Establish sales potential for your products

- Craft a value proposition

There are two types of market research: quantitative and qualitative. Quantitative research provides an understanding of trends in the data. Qualitative research provides insight into the reasons for attitudes, behaviors, and motivations that drive people’s actions.

Qualitative research can provide more in-depth and valuable insight than quantitative research alone.

Qualitative Market Research Methods

There are three primary means for conducting qualitative research:

- Interviews

- Focus groups

- Observations

Each method can be used together or separately.

Interviews provide first-hand experiences that uncover thoughts, behaviors, and feelings. They’re conducted individually with an interviewer and a subject. Interviews provide the most in-depth and rich insights through story-driven accounts. They take more time than the other methods, however, and can cost more than the other methods due to the amount of time required.

Focus groups use a trained moderator to gather insights and opinions from a small group. They’re most useful when testing a concept, a new product idea, or preparing for a launch and provide detailed information about feelings, attitudes, and opinions.

Observations are conducted with a researcher visiting a group of people to understand interactions and behaviors that occur within a space or context. They are most effective when the researcher is unfamiliar with the subject’s milieu and wishes to get information in the environment.

Step-by-Step Process to Conducting Qualitative Research

Each method requires preparation before meeting with research subjects followed by analysis. We’re sharing the step-by-step process for each below.

But before you begin a qualitative research project, you need to establish clear goals for your research and make a plan. Define what you need to know and why, and craft a strategy for your research by selecting the techniques you plan to use to gather data. You also need to decide what method or methods you’ll use to conduct your research.

Interviews

Interviews can be conducted in person or via phone or videoconference. The format you choose will depend on what makes your subjects most comfortable and the budget you have available.

Here’s a process you can use to conduct interviews that reveal the information you need.

1. Create a Topic Guide

Draft a document that includes how you’ll conduct the research, and create a list of questions.

Open-ended questions will encourage conversation and storytelling and help ensure you’re not asking leading questions that provide anticipated results.

2. Select a Setting

Will your interview be done in person, by phone, or over the computer? Will the research be recorded, or will you take notes? Will it be in a private space or a public, neutral setting?

Each of these decisions can potentially impact the results.

3. Recruit Participants

The next step is to recruit participants. Select a broad group of people who will cover appropriate demographics, and let them know what the study is about.

The way you communicate the nature of the study determines what participants think about it, so be careful you’re not steering the research before it begins.

4. Conduct the Interviews

When conducting an interview, start by building rapport and encouraging conversation.

Make eye contact if the interview is in person or via video, and provide enough time for responses.

Actively listen as your subject is speaking. If you have any questions, you can repeat back what you heard to request clarification. Pay close attention to body language and what is not said, as well as what is.

And lastly, you want the responses to be provided willingly and openly. Be careful to ask your questions in a conversational manner to avoid making the interview feel like an interrogation.

This process should provide you with a wealth of insights that will help fill out the data you’re missing.

Focus Groups

The process for conducting focus groups is similar to interviews. But focus groups are held in person, and they’re conducted differently than one-on-one interviews.

1. Create a Topic Guide

Draft a document that outlines how you’ll run the meeting, and create a list of questions. Again, be sure to ask open-ended questions and take care not to ask leading questions.

2. Recruit Participants

The next step is to recruit participants. Recruiting for focus groups is similar to finding people to participate in interviews as well.

Be sure you’re inviting people who fit your target customer profile.

3. Conduct the Focus Group

Similar to an interview, the moderator must create a safe and welcoming environment to make people feel comfortable sharing their thoughts and opinions.

The moderator should also prioritize creating a peer environment where participants feel equal and can relate to each other. This environment will help them feed off the energy in the room and provide their reactions to what’s being said.

Focus groups are especially valuable because they allow you to see how participants interact with one another when discussing your topics.

Observation

There are a couple of different types of observations — silent observation and interaction-based observation. Depending on what you’re trying to learn, you may want to ask your subjects questions about the behaviors you’re observing — or not.

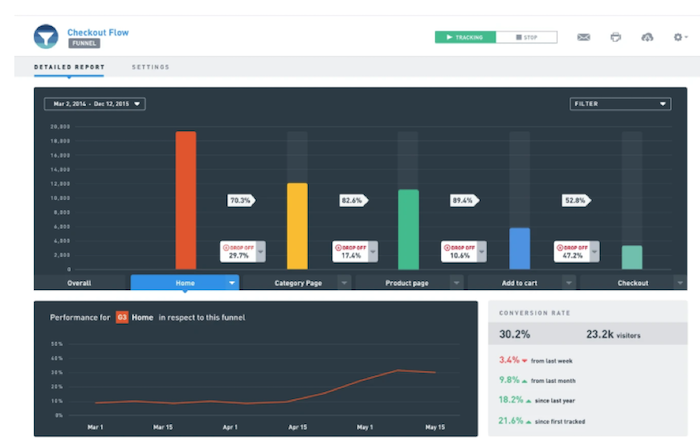

You also have choices in the method you use. You can physically go to the subject’s environment, or you can use software to track and record user behavior as they perform a task. User testing software often uses the latter.

There are several platforms that will help you record and analyze your data, such as VWO’s user testing product.

Here’s a process to ensure your observations are effective:

1. Decide What You Want to Learn

First, know what you hope to learn in your observation. Are you looking for typical workflows, how the subject interacts with software, factors in the environment?

Creating a list of the information you want to walk away with will guide your observations.

2. Determine Your Recording Method and Techniques

For an observation to be effective, you want to limit any disruption in the environment you are observing.

Video recording can be less effective when people know they are being filmed, so you may want to use note-taking for recording data in person.

3. Conduct the Observation

Again, if you’re visiting the space in person, limit disruption as much as possible. You want the environment to be as close to typical as possible. Take notes and only take video or photos with permission and if it’s necessary.

Observations are uniquely valuable because they allow you to gain insight about the subjects’ environments.

Analyze Your Results

Once you’ve completed the work with your subjects, whether you’ve used interviews, focus groups, or observations, it’s time to analyze the results.

Review what was said as well as non-verbal cues and reactions. Consider the stories and thoughts subjects shared and what you observed.

Start looking for overlap in your results. Begin connecting the dots between what subjects said and their attitudes, thoughts, and opinions.

Hypothesize what the data reveals, and consider if you need additional research to reach conclusions.

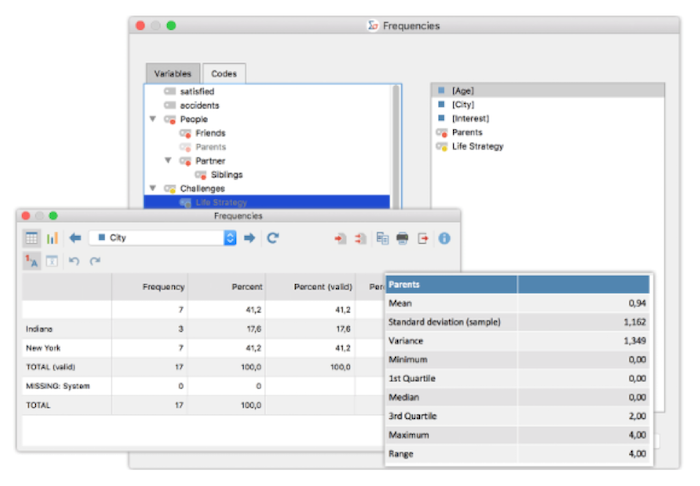

If you have a lot of data to sift through, you may find software helpful. NVivo and MAXQDA both offer robust solutions for market research analytics.

The conclusions you draw about what you observed is where the real value is with qualitative research.

Qualitative Research Provides the Best Insights for Startup Businesses

Startup businesses have an inherent challenge with business planning without a history of operations. Learnings from qualitative market research can fill the gaps through the use of interviews, focus groups, and observations.

These methods offer invaluable insight and can provide a robust platform to help you create a better business plan.