Top 7 FinTech Trends 2024

Top 7 FinTech Trends 2024

As the tech world rapidly changes with the recent AI breakthrough, so does the financial sector, and these innovations are set to revolutionize how we imagine financial operations nowadays. Experts from Forbes say that within seven years, the global size of AI-based digital banking apps will reach $61.30 billion, and this tendency will continue.

We will examine what’s trending in the financial sector for 2024 to help businesses of various industries and sizes keep pace with the ever-changing image of the tech reality of the 21st century.

Consumers Will Use More Fintech Apps than Ever

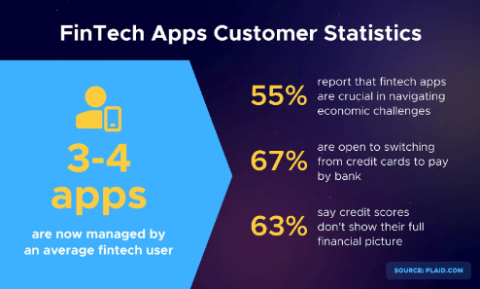

Since the rapid embrace of fintech during the pandemic in 2020-2021, the sector has seen sustained growth. 55% of consumers now report that fintech apps have been crucial in navigating economic challenges. Thus, there's been a significant growth in the number of custom fintech solutions downloaded by users seeking better financial management and decision-making tools.

This shift is also redefining consumer banking expectations. More and more people expect seamless integration of their bank accounts with the fintech apps they use daily. Currently, the average fintech user manages 3-4 apps, and this number is expected to grow as fintech continues to integrate deeper into everyday financial activities.

Adoption of AI and ML

By thoroughly analyzing data from customers' cash, credit accounts, and investments, AI empowers financial institutions to monitor clients' financial health and deliver more personalized services. ML models assess various factors to detect potential fraud, achieving a notable 20% reduction in the investigative workload.

Financial companies are enhancing smart banking services through cognitive automation, engagement, and advanced data analysis, providing deeper insights. Furthermore, artificial intelligence directly interacts with clients through chatbots and self-learning applications.

AI-powered chatbots and digital assistants can produce context-sensitive content, aiding users in tasks like choosing investment options and making complex financial decisions. Modern chatbots, reflecting the latest trends in fintech, can remember the context from past interactions, providing responses that are not only relevant but also enriched by historical user data.

Popularization of Blockchain

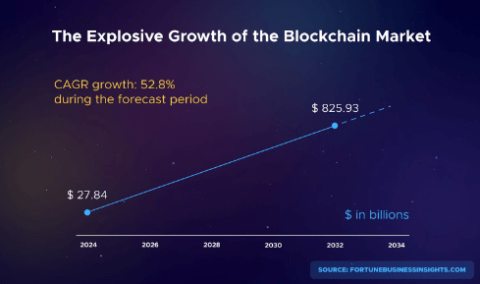

The global blockchain market is poised for explosive growth, and it’s projected to grow from $27.84 billion in 2024 to $825.93 billion by 2032.

Leading financial services like Visa, Mastercard, and PayPal are embracing cryptographic assets and enabling cryptographic payments.

Currently, international money transfers are both time-consuming and expensive. Blockchain technology addresses these issues by offering faster and more secure cross-border payment solutions at reduced costs.

Often referred to as a "distributed database" or "electronic ledger," blockchain technology records each transaction in a unique block linked to previous blocks in the network. All participants have access to this transparent ledger.

A transaction is considered valid only with the approval of over 50% of the participants. Each block features a unique hash, and completing each transaction requires verification, making compromising such a decentralized network challenging.

Virtual Bank Cards

Virtual bank cards emerged as digital versions of traditional credit/debit cards that reside within an e-wallet, not a physical wallet. They are now offered by both neobanks, such as Revolut, Monzo, Monobank, and N26, and established financial institutions like Bank of America and Capital One.

The primary advantage of virtual cards is enhanced security. Customers can make in-store payments using NFC or online purchases without the common risks associated with physical card fraud. Each transaction made with a virtual card typically requires authorization via the customer’s banking app, allowing for immediate deactivation and replacement of a compromised card within just a few clicks.

For example, neobanks like Revolut, Monzo, and N26 leverage virtual cards to facilitate peer-to-peer transactions, in-app purchases, and online payments even before issuing a physical card. Additionally, some challenger banks offer "disposable" virtual cards, which further secure transactions by changing card details after each use, thereby drastically reducing the risk of fraud.

The Growing Popularity of Digital Payments and Signatures

As traditional modes of payments gradually fade into oblivion, digital payments continue to expand, and the integration of electronic signatures and m-banking options is changing conventional ways of banking. This shift is phasing out the need for paper checks and statements, significantly reducing the use of cash.

Moreover, due to the automation of back-office services, paper consumption has been reduced in offices and bank branches. Digitalization of banking offers customers increased convenience and makes financial operations more environmentally friendly since it supports sustainable and ecologically friendly financial services practices.

Robo-Advisors for Daily Investment Operations

The widespread use of AI tools has transformed financial advising, so investors can always get personalized advice on future operations based on their activities’ history and market forecasts. Thanks to leveraging AI algorithms, robo-advisors and personal financial managers made this possible.

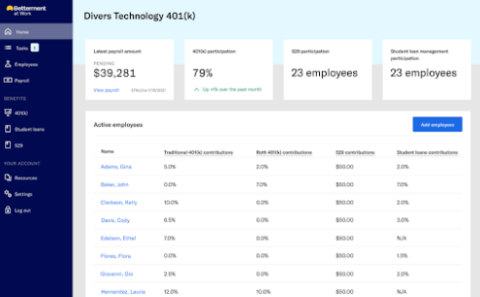

These technologies have become a highly profitable force within the financial sector, guiding investors on optimal spending and investment strategies. For example, robo-advisors like Betterment or Wealthfront can easily process and analyze large volumes of data and quickly adapt to market changes more swiftly than human advisors. Plus, they offer investors the most promising investment options to meet their financial goals.

Robotic process automation has gained popularity, especially among novice investors who may not have access to traditional financial advice. Innovative investment tools have significantly lowered the barriers to entry, allowing nearly anyone to start investing and potentially profit, even with minimal initial capital.

RegTech Streamlines Financial Regulations

As you know, financial institutions are highly regulated through laws, standard practices, and guidelines that the company must follow strictly. On top of this, companies, small and big, are obliged to keep an exact record of accounting, taxes, incomes, and customer transactions.

Such records are occasionally submitted to regulatory bodies to ensure the correctness of the data and whether each activity is conducted according to law. RegTech, or regulatory technology, has entered this scenario mainly to improve these processes so that institutions can better monitor compliance.

Such software automatically performs routine actions, supervises data security, and warns personnel to take necessary action against fraudulent activities. It also discovers non-compliant actions, aligns these actions with different regulatory standards, and sends reminders to all employees about the declared policy.

The penalties for non-compliance, however, are usually very high and may run into millions of dollars. For example, the Bank of America Corporation once had to pay $42 million to New York State for failing to disclose how it handled client orders sufficiently. RegTech reduces such risks by smoothing out communication with regulatory bodies, ensuring that data feeds are not broken, and monitoring compliance-PCI compliance rules, such as financial crime detection.

Embracing the Future with Fintech Trends 2024

The recent development of sophisticated AI tech has transformed the banking and financial sectors, beginning with increased usage of digital payments, ending with virtual bank cards, and moving through blockchain technologies to RegTech protective measures. These FinTech trends have totally changed financial companies' assessment, functioning, and customer interaction practices.

As technology advances, such innovations represent more than just an advantage of convenience; they move things toward greater sustainability and security in financial practices, both efficient and secure. From a business point of view, but also for consumers, these understandings are no longer optional; instead, they are necessary to be competitive and secure in a world changing so rapidly.

This shows a clear commitment to enhancing consumer experience, reducing environmental impact, and improving regulatory compliance. Looking ahead, we can be certain that continued adoption and refinement of these solutions will shape the future landscape of global finance, making it more accessible, transparent, and resilient.

Hire a software development company on The Manifest.