Top 5 Technologies Revolutionizing the Entire Fintech Sector

Top 5 Technologies Revolutionizing the Entire Fintech Sector

Financial technologies represented by the coinage “fintech” now mostly refer to all the trending and hi-tech means to make financial transactions and handle financial activities. The fintech mobile apps take the center stage in this revolution in the financial industry.

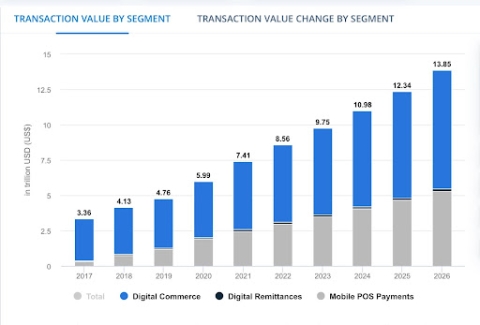

The staggering growth of digital payments alone shows how fintech apps have revolutionized banking, financial, and e-commerce transactions. Mobile and digital payment is destined to experience a 12.8% yearly growth between 2019 to 2023. According to this report by Statista, the accumulated transaction value of digital transactions is likely to touch $6.7 trillion by the year 2023.

Source: Statista

Fintech app developers increasingly rely on these smart technologies to deliver apps that easily stay ahead of the competition because of superior app user experience. In recent years, some fintech technologies have made an era-defining presence and to a great extent have brought a revolution in the way we handle finance and make transactions by using mobile apps.

Let’s have a quick look at the 5 leading technologies for the fintech sector:

Through the use of these technologies, fintech companies can build advanced solutions for their clients.

Artificial Intelligence (AI)

In recent years, artificial intelligence (AI) has penetrated many sectors and industries. In the financial industry, particularly for fintech mobile app development, AI is ensuring stronger data and network security and a personalized experience for users.

Based on historical user behavior patterns and transaction history, an AI-based algorithm can easily detect deviations or anomalies from regular patterns and behavior. This can further trigger security alarms for the administrators to watch out for.

Machine Learning

Similarly, Machine Learning (ML), another subset technology of AI is effective in learning from user behavior and user inputs resulting in data-driven insights that can be utilized for delivering a more personalized user experience to the users of fintech apps. Machine Learning (ML) algorithms are also helpful in detecting irregular user behavior and anomalies.

Based on these observations the security measures can be instantly strengthened for preventing fraud.

Searching for a machine learning consultant? The Manifest can help you connect with an ML expert.

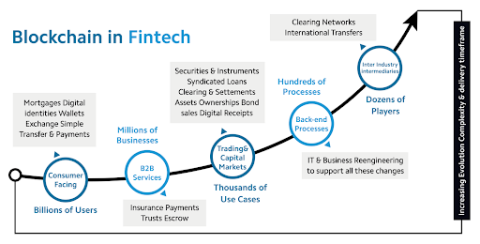

The Decentralized Blockchain Database

Blockchain is the decentralized database technology powering the first cryptocurrency, Bitcoin. Ever since it emerged as a breakthrough technology for protecting data, it continued to rise as the elementary technology empowering several cryptocurrencies. Soon, it was embraced by the fintech apps for stronger data security and ease of making data accessible based upon user roles.

Blockchain has mainly two major facets Cryptocurrency and Smart Contracts. How both of these technologies play a revolutionary role in the financial industry, let us try to explain.

Smart Contract

The smart contract comes as a protocol to facilitate more than one party to stay in a financially binding relationship to ensure smooth transactions based on their needs.

The biggest value proposition of Smart Contract technology is that one can completely do away with the third parties or mediators for carrying out peer-to-peer transactions. The terms of the underlying agreement can be easily determined and carried out by using custom software programs.

Smart Contract technology allowing automation of financial transactions based upon mutual agreement has proved to be highly effective for certain financial domains such as insurance, loans and credit products, etc. Just because a smart contract doesn’t need any mediator third-party for facilitating transactions, it drastically brings down the transaction and operational cost besides streamlining the processes to deliver a better customer experience.

Cryptocurrencies

Cryptocurrency first appeared in the financial sector through the emergence of Bitcoin and Blockchain decentralized database technology made this revolutionary digital currency possible.

Now, cryptocurrencies have been the subject of a separate economy offering amazing wealth creation opportunities to millions.

The biggest value proposition that made cryptocurrencies so much popular within such a short breadth of time is the completely tamper-proof protocol that does not allow changes or removal of an6 data. On top of that cryptocurrencies are also protected through multi-layered cryptographic encryptions. Today’s crypto-economy in the fintech sector has been a direct result of Blockchain technology.

Non-Fungible Tokens (NFT)

The cryptocurrency was just the beginning of a series of fintech innovations shaped by Blockchain technology. Now we have Non-Fungible Tokens (NFT) which are unique currencies that don’t allow swapping as with other regular currencies. NFTs are now the trending fintech solutions used by games and many other apps for allowing transactions of unique and artistic items.

Big Data

Big Data representing the huge volume, high velocity, and veracity of growing digital data comes as a key technology for the financial sector.

Since banks and financial institutions continue to produce a huge volume of digital data every single moment, this huge and exponentially growing data opens up unprecedented opportunities for analytics. No wonder, the world's biggest financial organizations rely on Big Data analytics for generating data-driven market insights.

How Big Data Benefits Fintech

In several ways, Big Data helps financial institutions and banks to stay ahead of the competitive curve. Let’s have a look at a few of them.

- Big Data allows fintech solutions to target customers based upon a wide spectrum of segmentation backed by data-driven insights.

- Big Data also helps in personalizing the user experience of fintech apps for every single user based on data-driven insights.

- Big Data helps a financial business stay tuned to the latest and emerging market trends.

- Based on Big Data analytics a financial company can more accurately predict the interest rates and the market receptivity for the same.

- Big Data analytics helps a financial organization revive its business model and turn it into a more customer-centric one.

Looking to partner with a big data company? Seek out your ideal partner on The Manifest.

Robotic Process Automation (RPA)

These days, streamlining workflows for faster performance is an acclaimed strategy of many enterprises. In the case of financial institutions and organizations, automating the transactions and backend tasks has the bigger significance of allowing large numbers of transactions without undermining the user experience.

This is why banks and financial organizations are increasingly embracing robotic automation for their mobile transactions.

Some of the key advantages offered by RPA for fintech apps include the following.

- Real-time and 360-degree access to financial insights and vital statistics.

- Automatic report generation based on different KPIs and metrics.

- Flagging off irregularities and performance bottlenecks to pass on to troubleshooting queues.

- Automatic adjustment of notifications and email messages based on user-specific insights and data inputs.

The emergence of conversational banking

Intelligent chatbots are increasingly becoming parts and parcels of banking activities in our time. Just a voice command on the go can be enough to receive a financial statement in the email or to get notified about a particular transaction.

Banking and other fintech apps are increasingly using chatbots to cater to customer queries ensuring faster response time and reduced involvement of the support personnel. Fintech Chatbots are also getting more equipped to provide the pros and cons of their investment decisions.

Tech is the Future of Fintech

The future of fintech apps is going to be shaped through these above-mentioned technologies. Fintech in the coming years is going to be more intelligent, automation-based, precision-driven, and secure thanks to the technologies mentioned above. Mobile wallets have already become commonplace. Now, voice transactions are trending.