Uncovering Untapped Opportunities With Competitive Intelligence in B2B Research

Uncovering Untapped Opportunities With Competitive Intelligence in B2B Research

Using competitive intelligence in B2B research helps businesses identify gaps in the market and discover new opportunities. By analyzing competitors’ strategies, customer needs, and market trends, companies can uncover untapped areas for growth and stay ahead in their industry.

When operating in a B2B context, everything is competitive – including your rivals – but it’s not enough to just observe rivals. It is essential to know how to gather competitive intelligence (CI) and act upon it. Understanding your competition through CI helps you discover unexplored resources. CI is, therefore, essential to implementing a competitive business strategy.

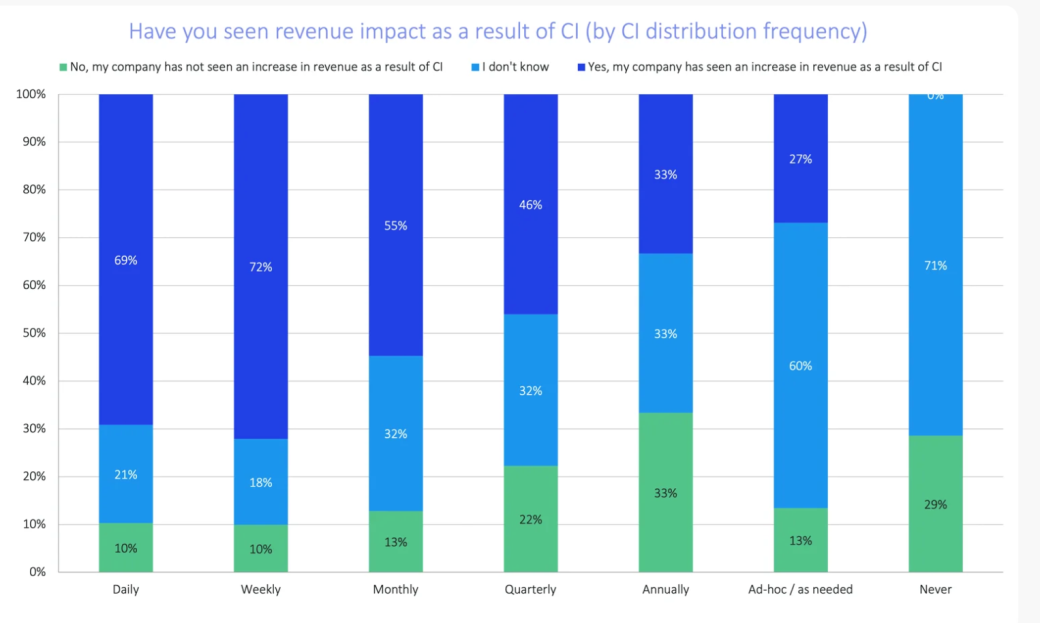

It’s no wonder that businesses that regularly share competitive intelligence data are more likely to experience revenue growth. In fact, 69% of companies that share CI daily and 72% that do it weekly report seeing a direct impact on their revenue as a result of using CI.

In this guide, we'll be looking at how you can apply the principles of competitive intelligence in B2B contexts to identify areas that could be useful for the growth of the business.

What is Competitive Intelligence?

Competitive intelligence (CI) in a B2B context refers to the process of gathering and analyzing data about your competitors and market environment to make better business decisions. It’s all about understanding what’s happening in your industry, identifying gaps, and staying ahead of trends.

There are two main types of CI:

- Tactical CI: This type of Intelligence is concerned with short-term activities. It is the kind of intelligence that allows one to make adjustments on the fly such as modifying marketing strategies or responding to competitive price levels.

- Strategic CI: Concerned with the long-term perspective. It assists in recognizing specific tendencies, predicting the future requirements of the market, and determining one’s business approach.

CI plays a decisive part in the decision-making process. Research has shown that 70% of organizations that are strategic planners tend to register increases in revenues compared to other organizations. By applying CI, organizations can analyze, understand, and appreciate the strengths or weaknesses of their competitors, make more informed strategic decisions, and focus on unexplored and potential markets for their businesses.

Key Benefits of Using Competitive Intelligence in B2B Research

Of course, one of the major strengths of CI is its ability to pinpoint market opportunities. By examining the competitive playing field, one will be able to ascertain the strengths and weaknesses of one’s competitors and, therefore, be able to know areas that are not being prioritized by one’s rivals. Such shortcomings allow one to make new products or services that aim to meet the needs of customers who have not been satisfied. In this sense, it may as well be a turning point that provides one with a competitive advantage over competition.

It is essential to be aware of your competitor’s weaknesses. Competitive intelligence enables you to find their flaws – the absence of originality, customer service, or development speed. Once these weaknesses are known, it is easy to strategize how your business can go beyond its capabilities and take the market share they are bound to lose.

Competitive force analysis enables firms to respond appropriately to their industry. By keeping track of the changes in the market, including the advancement of new inventions, you can alter your approaches to suit what is required at that particular moment. You’ll be aware of the new inventions, the laws accompanying those inventions, and the expectations of the customers. Such knowledge will ensure that you are always on the move, ready for various changes that ensure your relevance and competitiveness.

Lastly, CI enhances the processes and stages of developing a new product. When competing head-on with other brands, it is imperative to understand what those competitors give and what the end-users need. If you are aware of the wants of the consumers, you will be able to develop efficient ways to satisfy them. By knowledge of CI, therefore, you can fit in on all the areas of development of a product into a brace of the market and the present trends which are key in ensuring that your firm is not only competitive but also dominant.

Steps to Implement Competitive Intelligence in B2B Research

The use of competitive intelligence in B2B research technology is of utmost importance, and the need to be competitive in such an environment cannot be overemphasized. Here’s a step-by-step approach that can help you undertake the tasks effectively.

- Determine Your Business Objectives and Goals

- Identify Key Competitors and Key Industry Players

- Collect Information from All Sources Available

- Conduct a Mobile Market Research Competitor Analysis.

1. Determine Your Business Objectives and Goals

When approaching CI, the first step should be to determine what one hopes to accomplish. Is it possible to find new potential markets or look for weaknesses in the competition? These questions and many others will help you set clear objectives and be focused in your research process and efforts.

2. Identify Key Competitors and Key Industry Players

Next, you should explore your existing competitors and other industry players. This should include not only old companies but also new startups. Seek out companies providing the same or nearly the same products or services and study their positioning on the market. Knowing some of the people or their businesses you are in direct and indirect competition with will help you better understand the business environment.

3. Collect Information from All Sources Available

Before you start gathering information on your competitors, collect the required resources. You can use quite a variety of sources, such as:

- Market Reports: Such reports reveal the current dynamics of the industry and how the competitive players strategically position themselves.

- Social Network: Analyzing your competitor’s social pages can help you determine when new products are launched, how customers are engaged, and the level of engagement.

- News and Related Publications: Stay current with relevant industry news so you can report on every important event and change in the industry.

A market gaps analysis ensures you don’t miss any detail regarding the market landscape.

4. Conduct a Mobile Market Research Competitor Analysis

The last action is to evaluate the gathered information. Study your rivals’ actions and their strategies. Reflect on the following questions:

- What kinds of goods and services does the company provide, and what is their niche?

- Where does the firm operate, and what are its location frameworks?

- What kind of marketing techniques do they apply to grab customer attention?

- By identifying some gaps in the market, you will be able to figure out how best to position the firm to succeed.

By identifying some gaps in the market, you will be able to figure out how best to position the firm to succeed. With this clear understanding of the competitive landscape, you can now make informed strategic decisions, setting your business up to not only enter but thrive in untapped market spaces.

How Do You Do Effective Competitive Intelligence?

When performing competitive intelligence for your B2B research, the right CI tools can prove valuable. They allow you to monitor your competitors, identify trends in the market, and search for new leads.

Leveraging CI Tools for Deeper Insights

Using the right competitive intelligence tools, such as CRM software for tracking customer interactions and trends, can make all the difference in gaining a competitive edge. These tools allow you to monitor competitors, identify emerging market trends, and search for new leads. Key competitive intelligence tools like SEMrush, SimilarWeb, and Owler complement CRM software by providing a more in-depth look at market dynamics, giving you comprehensive insights.

Key competitive intelligence tools like SimilarWeb and Owler can be used for a more in-depth investigation, so let’s learn how to use them.

SimilarWeb

With SimilarWeb, you will know how much web traffic your business competition receives and how active its users are. It shows details such as traffic sources, demographics of the audience, and the most popular pages. This can show which competitors actually get more attention and how they try to draw in their customers.

- Strengths — Gives a nice presentation of website traffic along with those engaged in the competition.

- Weaknesses — In the free version, there are only a few data available and in some cases, the reliability of the information may not be so high with small websites.

Owler

Owler is useful in gathering attention to a particular company and its specifics, such as news, finances, and management employment changes. This is a great way to track your competitors' moves and what changes in the industry may affect your plans.

- Strengths — Competes with the Provision of up-to-the-minute news and activities of the competitors.

- Weaknesses — The scope is more on company information, thus it does not give an in-depth analysis of the digital marketing aspect.

How to Identify Untapped Market Opportunities

Finding target areas where market opportunities exist can be beneficial and give an organization an edge over its competition. With the help of a few approaches that are tried and tested and backed by appropriate evidence, these new areas can be explored. Here’s how:

- Conduct a SWOT Analysis

- Use CI to Understand Customer Needs

- Spot Emerging Trends and Niche Markets

- Maximize Business Case Studies to Enter New Markets

Conduct a SWOT Analysis

SWOT analysis — Strengths, Weaknesses, Opportunities, and Threats — is one of the most effective and time-saving approaches to determining market gaps. Businesses that practice SWOT analyses are more decisive in their competitive advantage and market opportunities. Pay attention to the drawbacks of your rivals’ products and the unmet demands of the market. Combining your strengths and weaknesses will make it easy to pinpoint gaps that have not been filled yet.

Use CI to Understand Customer Needs

Understanding your market better and how best your business can serve it means utilizing competitive intelligence. This can be done through numerous means, such as analyzing competitors’ tactics, customer reviews, and industry trends, which can provide valuable information on what customers want. Knowing that enables you to build a business around such unmet customer demands, thus giving you a competitive advantage.

Spot Emerging Trends and Niche Markets

Businesses use trends to spot emerging markets and need to use data for the same. Companies that track market trends with data-driven insights are said to outperform their competitors by 23% as per McKinsey & Company.

Take advantage of industry reports, social media reports, and search activities to monitor the areas that draw interest. These are not only underserved, but moving early on such trends helps target market segments that are still uncrowded.

Maximize Business Case Studies to Enter New Markets

Numerous businesses have used CI techniques to effectively enter new markets. For example, when the competition hasn’t seen any changes in direction, Netflix focused on the market of on-demand entertainment content long before the competition focused on streaming. Such a move, based on CI and analysis of trends, enabled the company to be the pioneer and the best in the market.

Likewise, Tesla waded into the electric vehicle market when it noticed its potential due to the increasing global focus on clean energy that other automobile manufacturers were yet to grasp.

These examples underscore how using competitive intelligence to identify untapped opportunities can provide a substantial lead in emerging markets, allowing businesses to establish themselves as industry leaders before others follow.

Leveraging Visual Content in Competitive Intelligence for Enhanced B2B Insights

Visual content formats, including images, infographics, short-form and long-form videos, motion graphics, and so on, are all the rave in the digital landscape today. They can be crucial in providing B2B companies with data (in this case, visual) to not only to understand competitors’ strategies better but also to track industry trends and customer preferences in real-time. Visual content analysis can reveal competitors' branding, tone, and positioning strategies, providing deeper insights into how they connect with their target audiences.

Visual Content Enhances Competitive Intelligence

As businesses increasingly rely on visual content to communicate brand messages and engage audiences, there is a lot of value in applying competitive intelligence in this field:

- Understanding Brand Positioning and Messaging: Visual content offers a direct window into competitors’ branding and messaging strategies. So, you can analyze the visual tone, color schemes, styles, etc. to infer brand positioning and other elements that enable the business to stand out.

- Tracking Audience Engagement and Content Performance: Not all visual content analytics data are publicly available, but at the very least, you can see the number of views, likes, shares, and comments on videos by other accounts. These offer a wealth of competitive insights that can indicate market trends and consumer interests.

- Spotting Product Trends Through Visuals: Businesses often rely on visual content to build awareness and highlight features when launching new products or services. By monitoring competitors' visuals, B2B companies can stay informed on emerging product features or innovations in the market and spot opportunities to innovate or fill gaps in their own offerings.

Best Practices for Incorporating Visual Content in CI Strategies

When analyzing competitors’ visual strategies, it’s essential to approach content systematically. A few methods include:

- Social media listening tools like BuzzSumo help companies monitor competitors’ visual content performance across platforms, providing insights into popular topics and preferred content formats.

- Reviewing video content on various platforms can highlight competitors’ current messaging, new product launches, and customer feedback trends.

- Create a visual content database by organizing competitors’ visuals by category (e.g., product, branding, customer engagement) for easy comparison and tracking over time. This enables a more in-depth analysis of visual trends and facilitates quick reference when developing your own content strategies.

- Competitors may use different approaches on different channels. Track content on a variety of platforms to reveal variations and similarities

- Tools like AdEspresso or Facebook Ad Library allow you to view competitors' ads, which can help identify successful ad formats, visuals, and messages. This also reveals ad frequency and placement strategies, indicating which products or services are their focus.

- Use CI to benchmark your visual content performance against industry standards. Platforms like Sprout Social or Hootsuite Analytics can show you engagement benchmarks, such as average likes, shares, or comments, by industry.

Best Practices for Ethical Competitive Intelligence

Competitive intelligence (CI) effectively understands the market. However, it must be practiced within the limits of ethics. You can maximize your ability to use CI without getting your hands dirty by first adhering to the law, respecting others' privacy, and avoiding potential landmines. Here’s how:

1. Avoid Legal Means When Collecting CI Data

When obtaining data, make sure that you do not go beyond the law. Gather data that is in the public domain, including market surveys, social media, and competitors' websites. Seek information that is non-private or privileged, as it can have legal ramifications. Understand the regulations in your sector to be sure you are not infringing on data protection, such as rules and regulations.

2. Adhere to Business Norms and Do Not Trespass the Confidentiality of Rivals

Even if the documents are available, this does not mean that they have to be available to the public. Remain ethical and do not resort to illegal practices; engaging in competitive intelligence does not mean stealing or phishing sensitive data from your competitors. Legal and fair sources are the only avenues through which CI employees commit a theft.

3. Circumvent the Risks Associated with Competitive Analysis

We would create a personal database about how competitive firms operate and what they do to satisfy their customers. Obtaining too much data and overemphasizing competitors can have negative consequences.

Striving for efficiency can also be detrimental if this simply results in any course of action being selected. You should also consider the presence of factors that distort the results you obtain. Maintain neutrality as much as possible and ensure that your analysis is relevant to your strategic objectives, not mere competition.

The Role of CI in Driving Future Growth

CI is important in fostering further growth by consistently augmenting companies with relevant knowledge about industry dynamics, market conditions, customer preferences, and actions filed by competitors. With this information, one can respond to changes, attract new customers, and develop innovations quicker than competitors.

CI assures the relevancy and flexibility of the business following the current market conditions and its capacity to attain sustainable success in the future. Integrating CI in your growth strategy helps to identify new business opportunities and build a competitive edge over others.