How Online Businesses Can Use Cloud Technology to Fortify Payment Security

How Online Businesses Can Use Cloud Technology to Fortify Payment Security

The cloud has been influential in the digital transformation boom throughout recent years and fundamentally changed how payments can be processed online and in brick-and-mortar environments.

In an age where data security has never been more important to fortify, the cloud offers next-generation solutions to save businesses from costly missteps.

The stakes have never been higher in the payment security landscape for startups and entrepreneurs alike. According to Lloyd’s of London, a major cyber attack on a systemic payments system could cost the world economy $3.5 trillion.

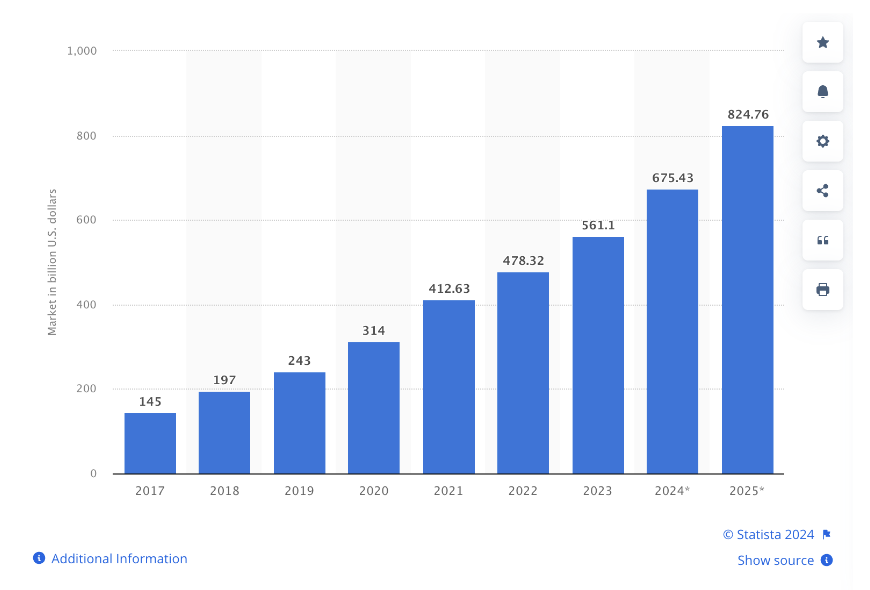

According to Statista, public cloud services end-user spending worldwide could reach almost $825 billion by 2025.

Buoyed by the post-pandemic landscape and the acceleration of the transition towards a cashless society, the cloud has emerged to offer payment providers faster, more cost-effective, secure, and scalable customer service.

Unlocking the Potential of Data

Crucially, cloud-based payment services for online and point-of-sale (POS) payment systems can help businesses manage customer data more safely.

Through an integrated cloud-based POS, it’s possible to unlock actionable insights into purchasing trends and recurring item purchases in an automated manner. This can help to securely understand when to reorder stock and how to market products to customers.

In a GDPR-focused landscape, these secure purchasing insights can be invaluable to businesses and would be secured through the system provider for peace of mind.

These data insights can also work wonders in providing more cloud-based security for in-store and online payments.

By adopting a reputable cloud-based POS, for instance, the burden of data management can be handled externally without the need for risky in-house management of sensitive customer information.

Instead, cloud POS providers remove the dangers of handling high-risk data by handling the security needs of data storage in a remote, secure location. This means that startups can access transaction data and other insights in real-time through data synchronization tools without the associated dangers.

Utilizing AI in Cloud Solutions

So, how can the cloud specifically counter security threats for startups through payment insights? As the volume and complexity of financial transactions continue to grow, artificial intelligence has emerged as a leading solution in fraud detection.

Through machine learning and pattern recognition, AI solutions can actively adapt to threats based on real-time analysis of transaction data to identify abnormalities that could be a sign of fraudulent behavior. These could include things like an unusual amount to spend, not a typical currency, location, etc.

Because AI is more adaptable than rule-based detection systems, machine learning has the freedom to monitor and evolve as threats become more sophisticated or clandestine.

Cloud solutions can offer more behavioral analytics in payment security. They can scour a user’s transaction history to spot unusual transactions or purchasing behavior that doesn’t suit the buyer’s historical transactions.

In addition, AI can use predictive analytics to help institutions identify and block fraud risks before they can wreak havoc and can help stamp new approaches to payment fraud in their formative stages.

In return, this can save institutions and individuals many resources, including time and money.

Cost-Effective Security

The best entrepreneurs constantly seek ways to offer security at a low cost without sacrificing efficiency or quality.

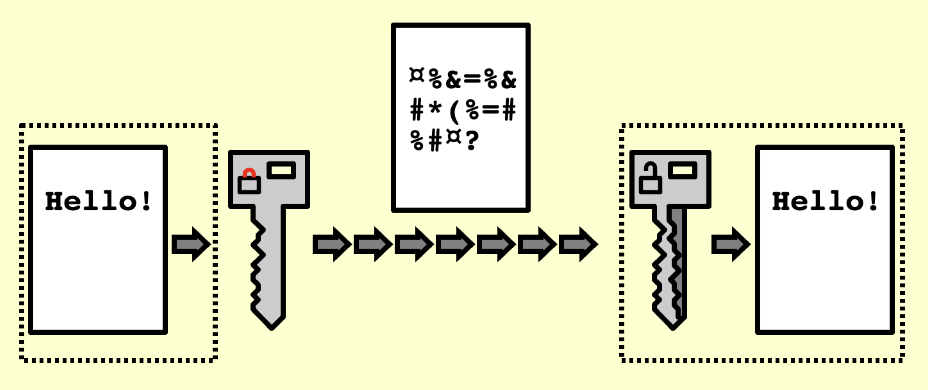

With this in mind, the techniques offered by cloud-based payment processing systems such as encryption algorithms, can protect customer data via a range of built-in security protocols like encryption and tokenisation.

Because these services are handled entirely by the provider, there’s no need to hire cybersecurity specialists or undergo comprehensive training to ensure employees are ready to stamp out instances of fraudulent activity. Instead, a relatively low amount of training will be required to ensure staff can use their respective cloud-processing systems, and the providers will handle everything else.

Compliance as a Service

Another key facet of cloud-based payment processing is the ability to enable startups to remain compliant alongside their access to extensive big data insights into operations.

By accessing a provider’s robust suite of security protocols and compliance standards, entrepreneurs can know that the actionable data they utilize through their processors and POS systems will always comply with the latest regulatory requirements.

With compliance remaining a crucial component of operations throughout a vast and varied range of industries globally, cloud-based payment providers can offer timely protocol updates to ensure minimum disruption in the face of regulatory changes concerning businesses.

Reaping the Rewards of the Cloud

With the cost of a potential cyber attack on a systemic payments system estimated to be $3.5 billion globally, it’s clear that cloud-based security to bolster transaction security is a necessity for startups.

Because this industry is rife with fraudulent activity and attempted data hacks, choosing the right payment providers for brick-and-mortar and online transactions is imperative. Without a doubt or exaggeration, it could make or break a business.

With this in mind, entrepreneurs must assess their options and choose solutions that are proven to use cloud technology to protect the security of their clients.

Security should be at the forefront of every successful entrepreneur’s mind and can make all the difference in scaling a startup effectively or losing customer trust in those all-important formative years.