How to Integrate a Payment Gateway Into Your E-Commerce App

How to Integrate a Payment Gateway Into Your E-Commerce App

Contributed ContentPayment gateways play an important role in e-commerce and help authorize payments between merchants and customers.

Cash payments are already considered outdated as many opt to use credit or debit cards along with mobile payments. These latter options are more convenient and make payment operations easier and more efficient.

Additionally, online sales are growing as more people choose to buy from e-commerce businesses. According to Amex Digital Payments Survey, nearly three-fourths of consumers (73%) have made three or more online purchases within the last year.

The growth of online purchases via mobile devices is obvious due to the increased popularity of mobile-commerce also known as m-commerce.

If you plan to create an m-commerce app, you need to integrate a payment gateway to let your customers make payments easily and securely.

Payment Gateways Make Online Payments Possible

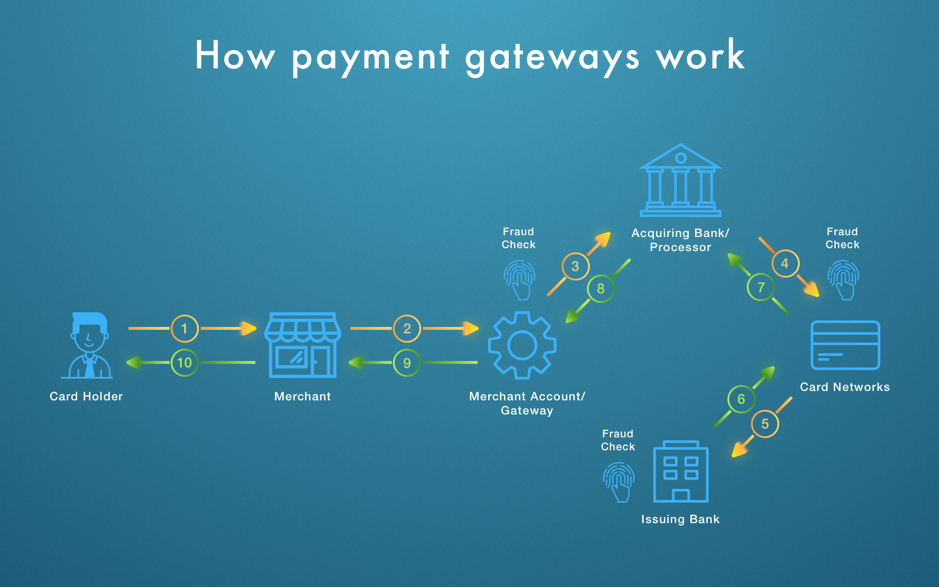

Payment gateways connect transaction and payment processors which are financial institutions.

Apps cannot connect directly to financial institutions due to security restrictions; the payment gateway acts as a mediator between these two steps of the payment process.

This means that payment gateways help encrypt payments to provide users with secure transactions and processing of personal data.

If you don’t want to be responsible for keeping third-party data safe but need a payment feature in your future mobile app, a payment gateway is a perfect solution.

Payment Gateways Perform Multiple Complex Actions in a Few Seconds

An internet connection is required to let users use the payment feature on demand. Before they can make a payment, they will need to enter their card information and other personal information.

Once this information is entered, it will be sent to the payment gateway system and then to the bank associated with the credit card.

The bank will confirm the information entered and will check the user’s account and balance to ensure they have enough funds to complete the transaction.

When the bank confirms the user has enough funds, the bank connects with the merchant to authorize the request. As the final step, the specific sum of money is charged from the user’s account and sent to the merchant within a few days.

This process consists of multiple steps but only takes a few seconds to complete using a payment gateway.

Merchant Accounts Allow You to Receive Online Payments

Merchant accounts act as an online bank account. They store money for sales for a few days before the funds are sent to the actual bank account.

When business owners use a payment gateway in their app, the transaction should be verified by the consumer's provider first and then it can be sent to their merchant account.

Merchant accounts help users use payment features while keeping everything secure. It is possible to open a merchant account in any acquiring bank and integrate it with payment gateways if it is necessary and supported by the bank.

Alternatively, you can use a credit card payment gateway provider such as PayPal or Stripe that provides customers with a merchant account.

There are two types of merchant accounts:

- Dedicated merchant accounts are available only for businesses. These types of merchant accounts are not cheap and take a lot of time to set up - there will be numerous checks including security checks during the set-up process. However, dedicated merchant accounts allow you to control your finances properly and there are available payment processing fee rates depending on sales volume. Simply put, the more you sell, the lower your fees become. Also, dedicated merchant accounts transfer funds much faster (up to 3 days compared to 7 days maximum in other accounts).

- Aggregate merchant accounts are used for most types of businesses. These accounts don’t give you much control over your funds and are more limited than dedicated merchant accounts. They are the cheaper option, but it takes more time to withdrawal money.

Whether You Sell Digital or Physical Product Will Determine if a Payment Gateway Will Work for Your Business

There are different approaches to mobile app payment integration depending on the goods you plan to sell.

For example, if you want to sell digital content, then your business must comply with Play Store and App Store policies (depending on the platform). All transactions should be performed via Apple ID or Gmail.

Both companies offer special APIs and libraries to developers to integrate the support of Apple or Google Play systems. In this case, the App Store and Google Play will perform all transactions.

If you plan to sell physical goods, then mobile payment gateways are the better choice. To connect a payment gateway with an app, developers must use proper APIs.

Make Security a Priority When Using a Payment Gateway

If you work with customers’ banking data, obtaining a PCI DSS security certificate is a must, even if the payment gateway you use is highly secure.

To do this, you need to make sure that your information system that stores banking data meets all the demands of PCI DSS. That is, PCI DSS certification is a rather long procedure that includes verification of 12 categories:

- Protection of computing network

- A configuration of informational infrastructure components

- The protection of stored data about cardholders

- The protection of transmitted data about cardholders

- Antivirus protection of informational infrastructure

- Informational system support

- Access control to cardholders data

- Mechanisms of authentication

- Physical protection of informational infrastructure

- Logging of actions

- Control of informational infrastructure protection level

- Information security control

Then, you need to consult with specialists to eliminate all vulnerabilities they find.

After you’ve fixed everything, your company will be audited by an organization that has a Qualified Security Assessor, who will decide whether your company meets the requirements of the certification.

This verification process is complex and can be lengthy, but it is well worth the effort.

Consider Popular Payment Gateways

There are many payment gateways available on the market. You should consider each one before deciding which one is best for your business.

PayPal Is One of the Most Well-Known Payment Gateways

Chances are you’ve heard of or used PayPal before; it is one of the most popular payment gateways.

PayPal is a provider of payment services for more than 200 countries and can process 25 types of currencies.

It’s free to integrate PayPal gateway, and it provides you with an aggregate merchant account for a fixed fee - 2.9% from the total amount of transactions plus $0.30 per each additional transaction. PayPal offers many useful features and it is permanently upgraded, so it is a very good option for m-commerce businesses.

Braintree Offers Fraud Protection

Braintree is a subsidiary of PayPal and provides a fraud protection system, payout in two days, and online customer support.

Braintree is used in more than 40 countries and supports more than 130 currencies.

Braintree offers developers SDKs (software development kits) that are written in 7 programming languages, including support for iOS and Android.

It is free to integrate Braintree and you don’t need to pay any fees for the first $50,000. However, when this amount is exceeded, you will need to pay 2.9% of the total amount of transactions and $0.30 per transaction.

Stripe Is Another Trustworthy Option

Stripe is another leading payment gateway you can trust; it offers authorization, a checkout feature, analytics, financial reporting. All required data can be controlled via Stripe Dashboard mobile app that is available for iOS and Android.

Stripe’s fees are comparable to PayPal and Braintree: you will pay 2.9% from the total amount of transactions plus $0.30 per transaction at the very beginning.

Choose Your Payment Gateway App Carefully

Integration of payment gateway is a process that requires research and serious consideration. If you choose wisely, you will get a reliable and secure payment gateway that will help your customers perform financial operations securely and efficiently.

Consult with e-commerce specialists and give your users the high-quality service they deserve.