Software Development in Finance: AI for Digital Money Management

Software Development in Finance: AI for Digital Money Management

Artificial intelligence is among those transformative technologies that change our lives. We’ll not cover all its peculiarities and controversies here but discover how it works with fintech software development.

You’ll see how AI can be applied to software development for finance and enhance it greatly. There are tools that can improve the programming experience, speeding the process up and making it much more convenient.

Various AI applications, from analytical to generative, can deeply change how money works. So, how does the fintech AI market develop?

Need AI development help? Connect with the best AI development companies on The Manifest.

AI Advances are a Driving Force in Fintech

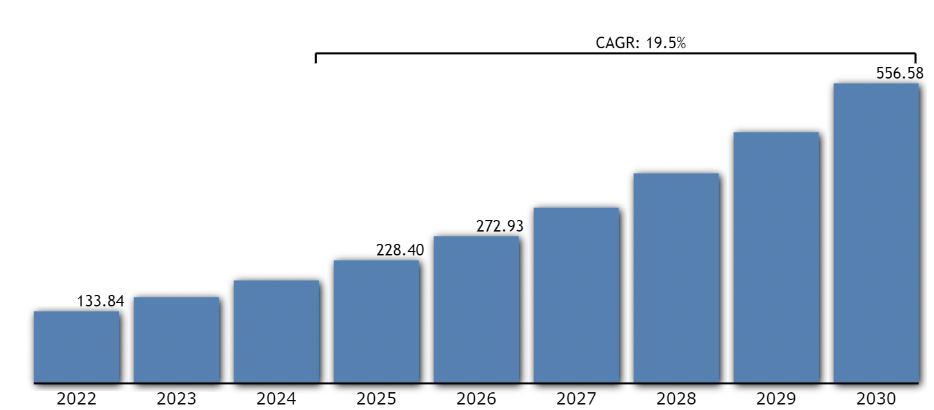

Let’s start by overviewing the fintech market in general. What can it propose to us in terms of software development? Look at the chart below to evaluate and see its quick growth. It is now around $160 billion, predicted to be almost 3.5 billion in 2030. Let’s now see how AI is used here.

Source: Vantage Finance

Despite the exact numbers varying, according to various business analytics, AI in the fintech market currently has more than $8 billion in total. According to their predictions, it’ll have more than $50 – $70 billion at the end of this decade, showing steady growth. Now that the market is flourishing let’s explore how specifically you can apply AI for fintech software development.

Use Cases for AI in Finance

From neobanks and large crypto stocks to personal money planners and microcredit apps, fintech apps help people manage money in various ways. See below the range of the most common financial apps, bearing in mind that there are tens of combinations and other, more specific types.

Source: Concetto Labs

Artificial intelligence has become an important addition in software development and virtually all industries and life situations, improving and changing how they work. Its immense capacity to proceed with information, distinguish patterns, generate new information, and potential sentience raises many existential questions.

AI applications mentioned below, are useful for different app types, so let’s explore them!

- Business analytics includes various analytic tools depending on what the app intends. It includes risk prediction and management, quantitative economy data analysis, predictive analytics based on historical data, and automatization of routine business processes. Utilizing such tools in various aspects of business functionality, you can make your business intelligent and much more competitive.

- AI assistants are generative AI tools to generate financial advice and help people manage their money. They can be trained on thousands of economic data to learn how to manage money smartly and answer the most tricky and meticulous questions about personal budget planning, business development, investing, trading, and similar topics in money management. It’ll be valuable for all fintech apps, from budget planners to cryptocurrency wallets.

- Chatbots for support teams are also generative AI but focused on communicating with customers, handling their requests and complaints, and helping them to reach what they want. As fintech apps are often complex, implying various analytics and dealing with the sensitive topic of money, such a helpful AI will be a very fruitful addition to such an app.

- Algorithmic trading systems are neural networks specifically taught to trade assets on stock and currency exchanges. They can predict trading trends and, thus, are helpful for stock and cryptocurrency apps.

- Automatized regulation means that AI systems indicate which documents are necessary for each case, which laws should be obeyed, and how to manage all these regulations. They can also help with employee onboarding, ensuring all new employees correctly fill in their papers. Remember that fintech apps must comply with various security and financial regulations, so having such an automatization will be extremely helpful.

- AI-driven cybersecurity is another essential topic, as in many cases, you must protect your users’ money, except if you’re developing a simple budget-planning tool. Artificial intelligence networks can be trained to detect security flaws, bugs, and exploits. They can also predict how malefactors can use them to breach security and steal users’ data or money. If you can expect such issues, you can prevent them, which will greatly and significantly boost your security.

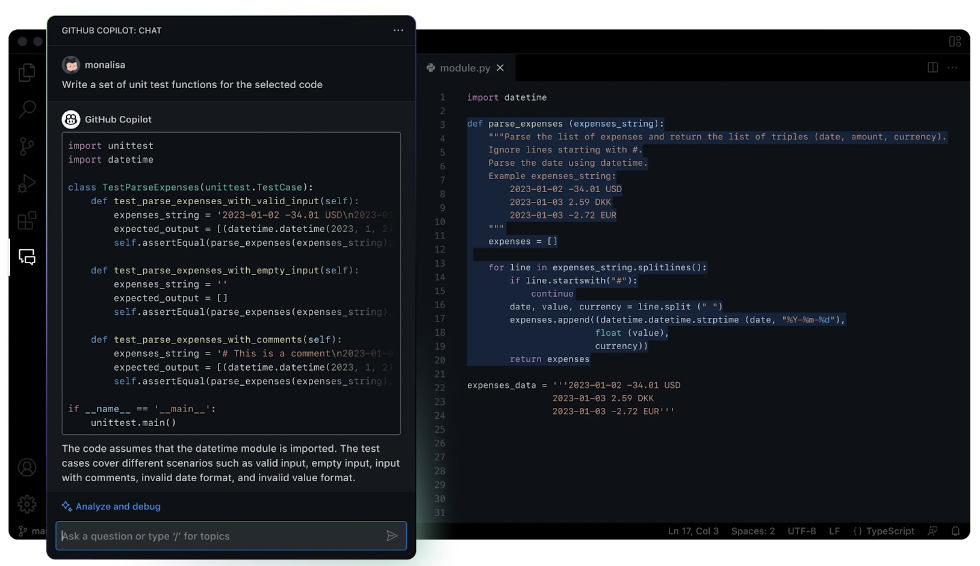

In addition, some instruments help with the programming process greatly. Copilot is a tool from GitHub that can enhance programmers’ workability many times. It predicts which code you’ll need during the practice, edits mistakes, and can even optimize already written code. It’s not specific and can be used for any software development, not just fintech.

Source: Github

As you see, it shows various code suggestions and recommendations and can communicate with a developer about all project matters. If used properly, AI tools can optimize everything, so let’s focus on their benefits and drawbacks now.

Benefits of AI in Finance

Automating all processes, big data management, and digital assistance are important elements of how AI can help, but there are more. So, let’s summarize how artificial intelligence enhances the fintech industry and software development.

- Optimization includes providing concise financial analytics and helping during the development, greatly improving all apps’ functions.

- Automatization of work processes and specific app tasks, such as stock trading.

- AI assistants for money management and support improve user experience greatly.

- Speeding up the development and improving the app’s information processing capacities.

- Improved safety due to the AI-driven flaws search, indication, and repairing.

Drawbacks of AI in Finance

The possible negative influence of AI development can be discussed very broadly, from job loss for many programmers to machine uprising scenarios. Here, we’ll detail specific risks for fintech software development.

- Costs and complexity are the most obvious drawbacks. Artificial neural networks require complex formulas and great coding and math skills to develop; they should be trained properly and then tested. Adding an AI feature to an application will usually cost no less than $30,000, and in the case of various features, such as business analytics, it can cost well more than $100,000.

- A lack of transparency follows from the inability to check how the AI network works due to its inherent complexity. It’s confusing not to know how your app works and whether your AI algorithms are unbiased, so it’s especially important to test your app regularly. In addition, proper support is necessary to ensure that all users’ inconveniences will be solved fast.

- AI overreliance means that if you automatize everything, you should be sure that AI will show you the correct numbers and you work with the correct information. The principle “garbage in – garbage out” (GIGO), known in software development, is especially relevant here. No matter how good your neural network is, if you feed inaccurate statistics, wrong financial data, or just irrelevant trading history, you’ll obtain only great confusion. So, it’s important to check the validity and relevancy of the data you work with.

The Future of AI in the Financial Industry

What do we have now?

Artificial intelligence usage in app development is becoming more and more widespread. Apps such as Copilot help in software development on all levels. They analyze code written, predict which code edits and options can be useful for any case, revise mistakes, and make smart advice in general. If you aren’t prepared for this new reality, you can perform less than programmers using such tools.

Additionally, various AI technologies can be used for fintech apps to improve the user experience and expand their capacities. Their analytical abilities proceed with large volumes of financial information and give concise analytics and suggestions, while generative AI serves as financial advisors and customer support. In addition, AI's ability to proceed with information can be used to handle cybersecurity flaws, automatize business processes, and enhance stock trading.

According to the rapidly growing market numbers, you have a lot of space here. AI-based finance is certainly the future of our world, so it’ll be exciting to participate in it.