12 Best Online Financial Tools for Small Businesses

12 Best Online Financial Tools for Small Businesses

Online financial tools can streamline business processes, giving internal teammates more time to focus on customer interactions and other business expenses. Learn more about the best online financial tools that can take small businesses to new heights.

Managing finances is one of the biggest challenges faced by small businesses.

Cash flow, budgeting, invoicing, and tax preparation are all essential tasks that require careful attention to detail. Luckily, there is a wide range of financial tools available to help small business owners manage their finances more effectively.

From accounting software to invoicing platforms, these tools can streamline financial processes, save time, and improve the accuracy of financial reporting.

In this blog post, we'll take a look at some of the best financial tools available for small businesses and how they can help improve the bottom line.

What Can Small Businesses Use Online Financial Tools for?

Businesses can use online financial tools for the following tasks:

- Accounting: Online accounting software can help small businesses manage their finances more effectively, track expenses and revenues, and generate financial reports.

- Invoicing: Online invoicing platforms can simplify the invoicing process, allowing small business owners to create and send invoices easily and track payments.

- Payroll: Payroll tools can automate the payroll process, calculate employee wages, and generate payroll tax forms.

- Tax preparation: Online tax preparation tools can make tax preparation less stressful.

- Expense tracking: Expense tracking tools can simplify the process of tracking business expenses and generating expense reports.

- Budgeting: Online budgeting tools can help small businesses plan their budgets and track their expenses to ensure that they stay on track.

- Financial planning: Financial planning tools can help small businesses create financial projections and plan for the future, taking into account factors like revenue growth, expenses, and cash flow.

The following online financial tools can support your small business by improving efficiency and saving time.

In need of extra support with accounting services? Search for a leading accounting firm on The Manifest.

12 Best Online Financial Tools for Small Businesses

Consider using these financial tools to support your business’s processes:

- Gusto

- FreshBooks

- Rocket Money

- Sage Business Cloud Accounting

- Float

- Xero

- Expensify

- QuickBooks

- SOS Inventory

- Zoho Books

- Square

- Vend

Gusto

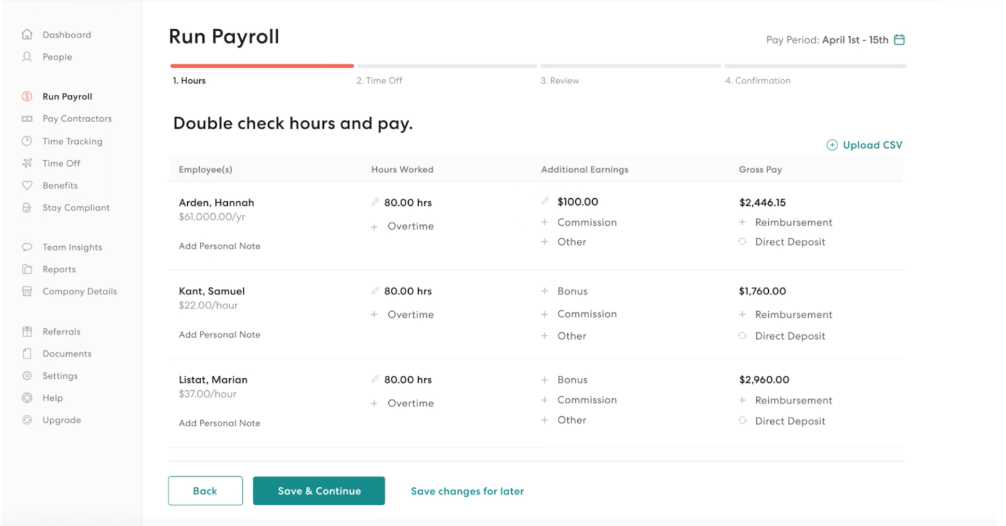

Gusto, formerly known as ZenPayroll, is an HR and payroll management system that helps with a variety of financial support tasks.

This platform can run unlimited payroll in minutes, allowing teams to get paid in just a few clicks. It also works well with contractors and other part-time employees. Your business’s payroll taxes can also be filed automatically with no additional charge.

Along with benefits and time-tracking capabilities, Gusto works seamlessly with other integrations, which could be other financial tools to streamline your business.

FreshBooks

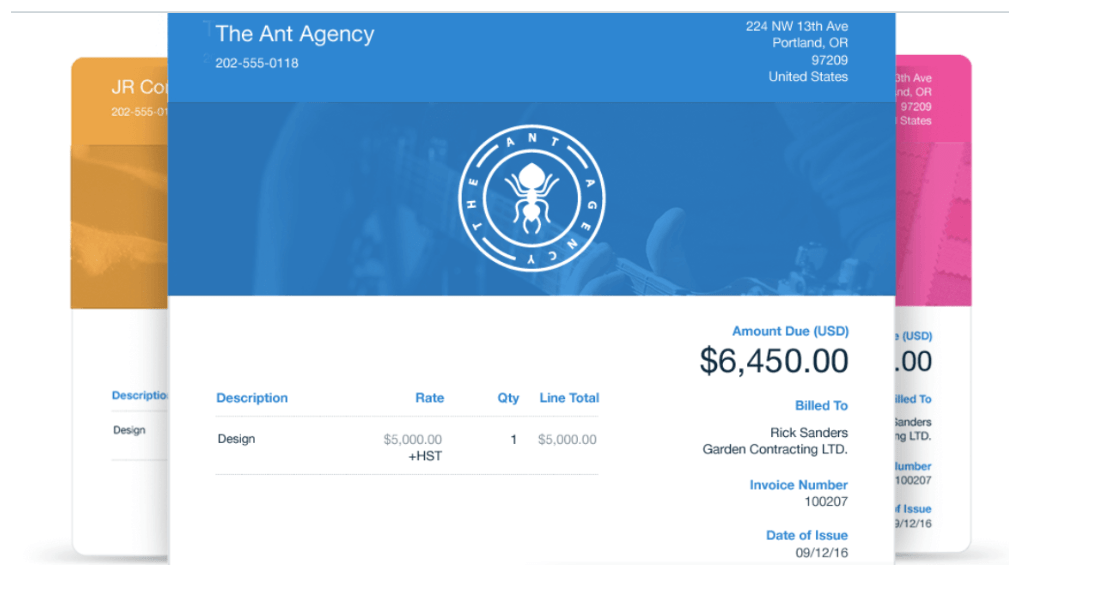

FreshBooks is an easy-to-use, cloud-based accounting software that tracks unlimited expenses and creates unlimited estimates for businesses. The platform is great for beginners and available for use with a mobile app.

The financial tool allows businesses to create professional invoice templates, maximize productivity with time-tracking software and help with bookkeeping services.

Along with functionalities that support client communication like expenses and receipts, FreshBooks provides payroll support that helps with internal team management.

Users can try out FreshBooks with a free trial or pay $15 monthly for this financial tool.

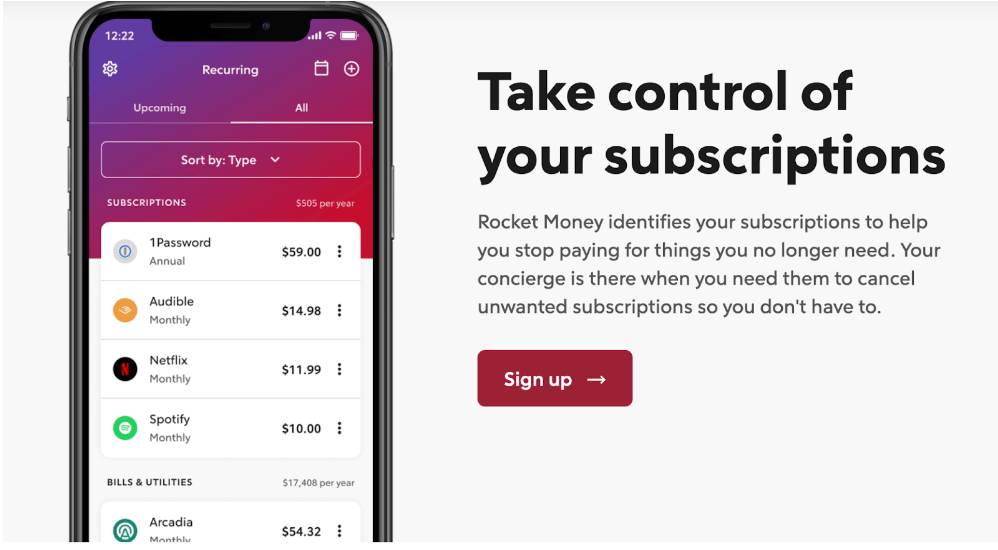

Rocket Money

Rocket Money (formerly known as Truebill) makes money management easy. While primarily used a budgeting app for personal expenses, it can be used for managing business expenses and subscriptions as well.

This app is a great financial software for small businesses because it analyzes spending and subscriptions on a monthly basis while comparing them to prices for other similar services.

Sage Business Cloud Accounting

Sage Business Cloud Accounting is a cloud-based accounting software that offers a variety of features and integrations that benefit small businesses.

The features include invoicing, bank account reconciliation, inventory tracking, budgeting, and bill pay. It also seamlessly integrates with Microsoft Office.

One drawback is that payroll isn’t included, so businesses will have to find another tool to support that process.

Float

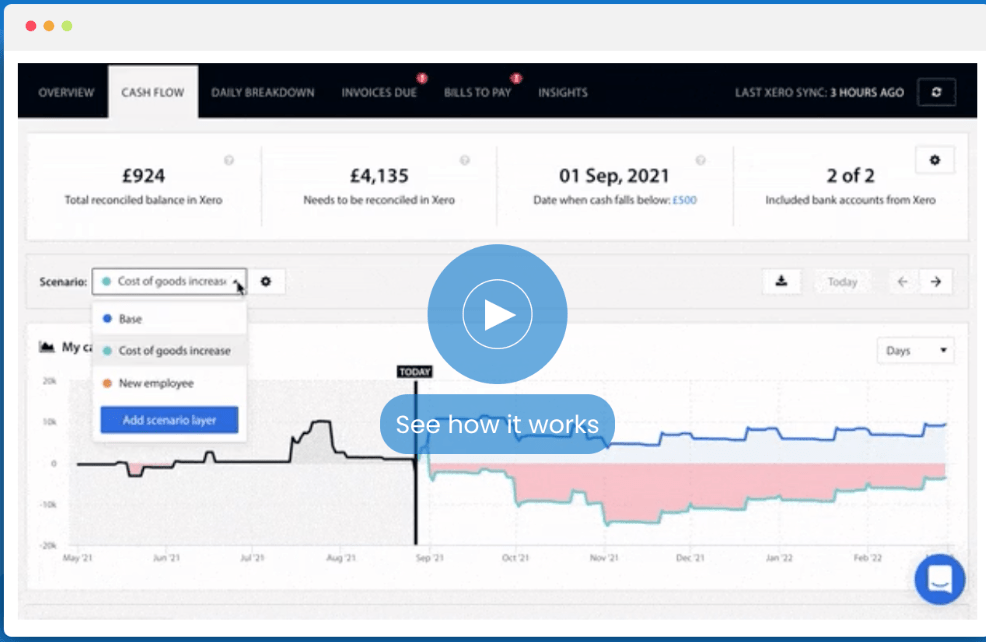

Float is a cash flow analysis tool that helps businesses track past patterns to forecast their financial future.

Users of Float can receive a real-time view of their cash flow to help them make confident decisions about their business’s financial choices. Your team can also run scenarios to see what could happen to your cash position if you hire a new employee or pay a large bill.

Float integrates well with systems like QuickBooks and Xero.

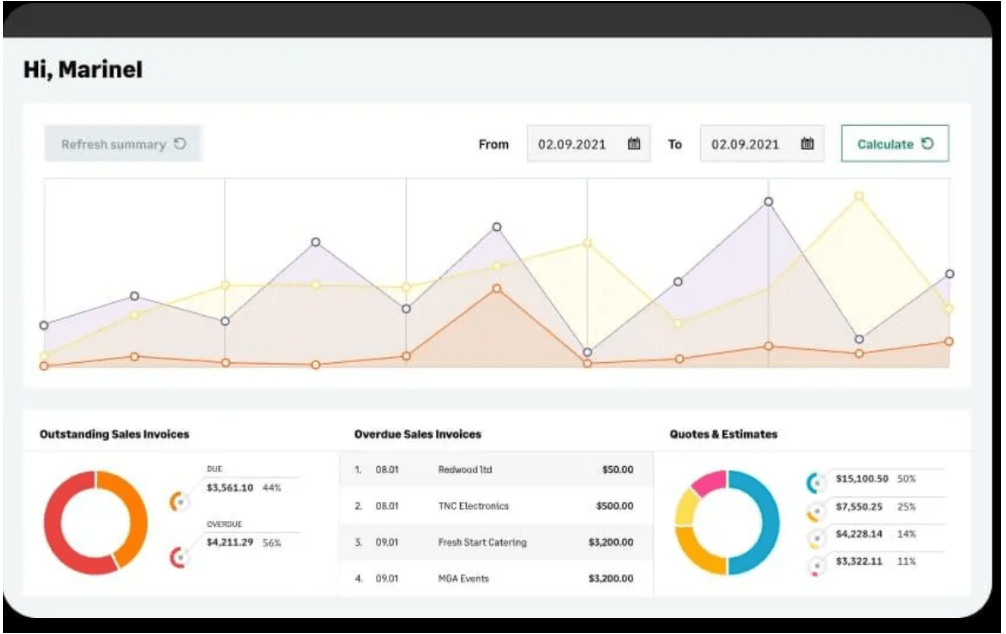

Xero

One of the most popular accounting software for small businesses is Xero. It works well for businesses that need to track projects and need assistance with bookkeeping.

The user-friendly system allows users to track inventory management, purchase orders, run payroll, and send out quotes and invoices.

Xero also integrates with other apps that help with expense management and other financial tasks.

Xero offers different pricing plans that work well with businesses of all sizes.

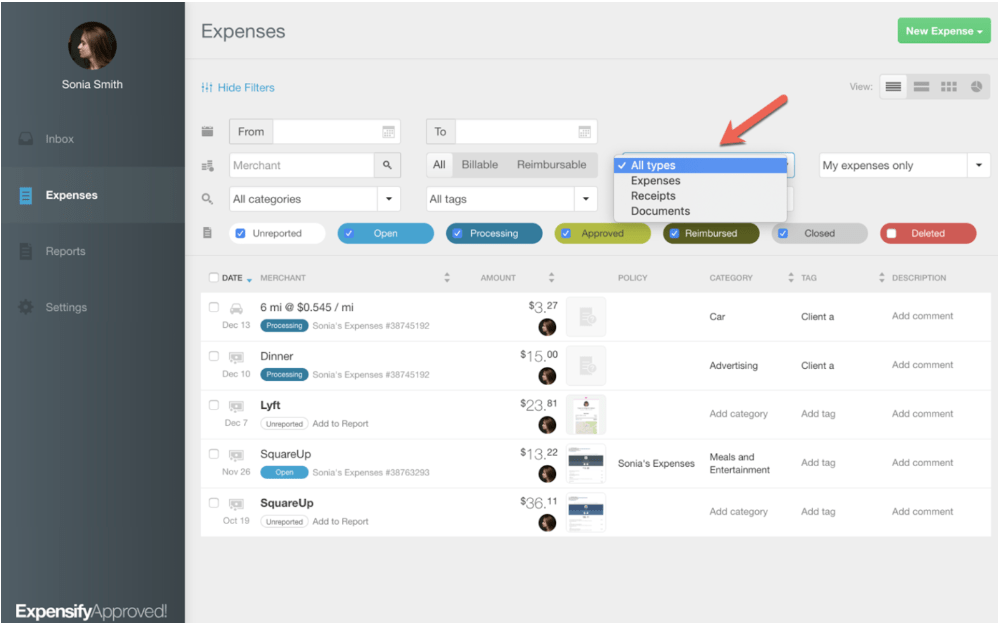

Expensify

Expensify makes small business spending easy. The expense reporting tool allows employees to scan receipts or upload expenses for approval or reimbursement.

This system integrates well with other financial apps to make managing money even easier.

Small expenses can be hard to track – but Expensify makes it seamless.

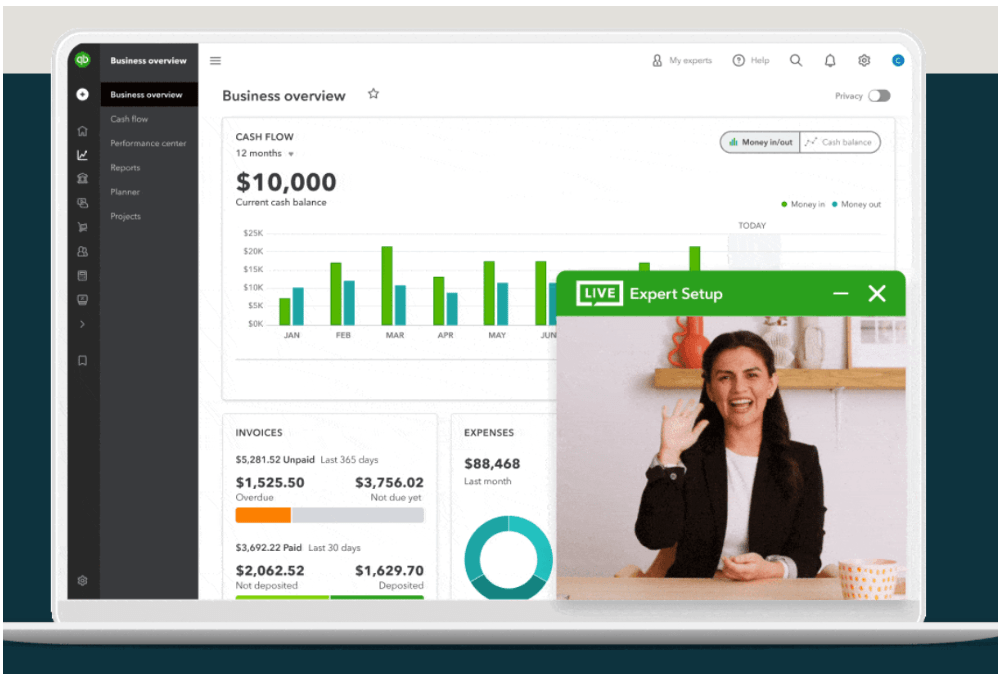

QuickBooks

QuickBooks is a classic accounting software that’s been used by organizations and freelancers alike for many years.

Businesses can do it all on the intuitive accounting software, from tracking inventory, paying bills, organizing receipts, and maximizing tax deductions.

The comprehensive software also works well with integrations while allowing businesses to invest in some of their advanced features like business analytics.

Quickbooks online can be customizable for any small business accounting needs.

SOS Inventory

SOS inventory is a cloud-based inventory management system that helps business track their goods and services.

Along with integrating well with accounting tools like QuickBooks, the system helps with generating sales reports and ordering packing and shipping features.

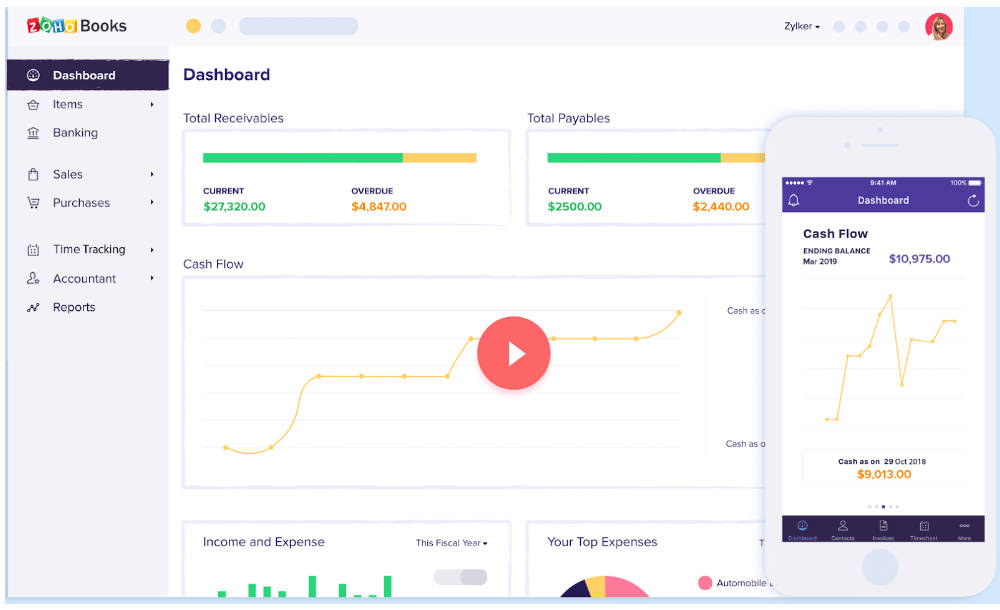

Zoho Books

As one of the most comprehensive accounting software on the market, Zoho Books meets all of a small business’s needs as an accounting solution.

Zoho Books sends invoices, tracks expenses, manages payments, and connects well with bank accounts.

The software contains everything a small business owner will need to manage their business finances.

Square

Square is an e-commerce solution that helps customers pay seamlessly. This financial management tool helps many small business owners have an easy way to take credit cards for their goods and services.

Their point-of-sale system also makes it easier for businesses to process any payments. Square can integrate with systems like Xero, QuickBooks, and WooCommerce.

Square prides itself on being “connected and comprehensive” by bringing all sides of a business together.

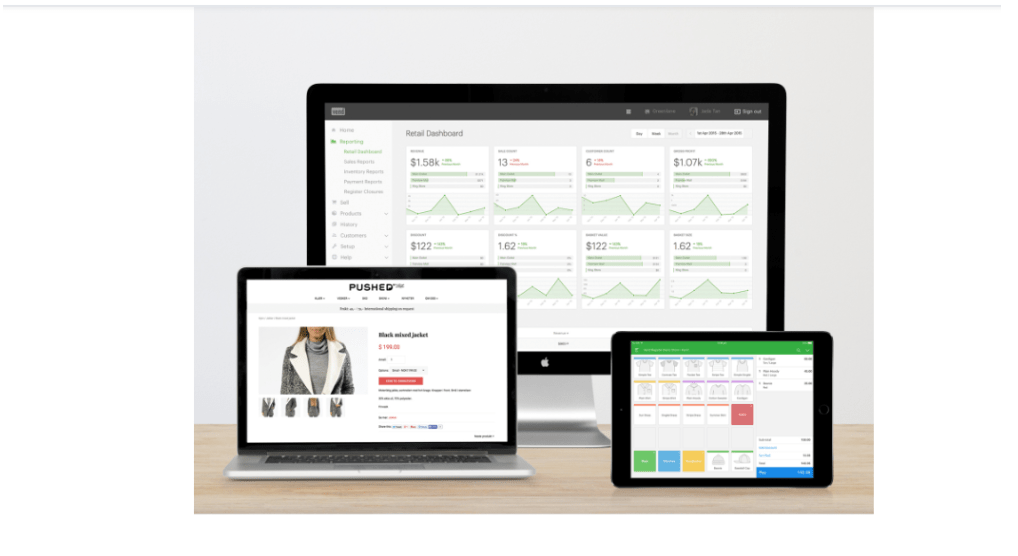

Vend

Vend makes sales easier for all business types. Branding itself as one of the world’s easiest point-of-sales software to use, it works seamlessly with any existing hardware while syncing financial data right to the cloud.

The robust solution includes tracking inventory management, order fulfillment functionalities, and tracking data.

These Online Financial Tools Will Impact Your Company’s Bottom Line

Online financial tools have revolutionized the way businesses approach their finances.

These tools have made financial management easier, more efficient, and cost-effective. Whether it's accounting software, invoicing platforms, or tax preparation tools, there is a wide range of financial tools available to suit the needs of any small business.

By embracing these online financial tools and incorporating them into their everyday operations, small businesses can stay competitive, save time, and gain valuable insights into their financial performance.