How to Improve Budget Performance With Scenario Planning

How to Improve Budget Performance With Scenario Planning

Contributed ContentScenario planning can improve the overall performance of your budget by letting you plan for challenges and opportunities to securely meet your company’s growth objectives.

Budgeting is basically an educated guess based on past performance and applied to future goals. For a growing business, though, how a company has performed in the past may provide little insight into how it will do when faced with new challenges.

Considering the current pace of business, challenges can arise quickly.

Scenario planning can help companies keep their budgets on track to achieve their goals. Scenario planning analyzes possible situations and shows how those challenges and opportunities can impact an organization’s budget and ability to achieve its strategic targets.

What Is Scenario Planning?

Budget planning is typically half data analysis and half fortune-telling. Using previous budgets and results, organizations can learn from past mistakes and set reasonable numbers.

Still, your industry’s environment changes every year, you have little control over external factors, and your organizational goals this year are likely different than they were last year.

Your budget may consider these shifts, but a plan that tries to predict twelve months into the future is not always as flexible as it needs to be. As a result, your budget’s performance may not be as good as you would like.

This is where scenario planning comes in. It’s a strategy that can help remove some of the uncertainty from your budget while providing the flexibility to take advantage of unforeseen opportunities. As mentioned in the Wall Street Journal article, “How CFOs Can Use Scenario Planning as a Strategic Tool in an Uncertain Economy,” scenario planning can help financial leaders stay ahead of potential events rather than react after they occur.

Scenario planning is building out multiple potential plans against important business factors and seeing the effects of those changes. Imagine that your annual budget is your “happy path” – if everything goes according to plan, it defines the assets it will take to reach your business goals.

By building out scenarios, you can plan when your assumptions fall short on the key drivers that your business goals depend on. What if the sales of your newest product are lower than your projections? What if your sales cycle is twice as long next year as it was this year? What happens when a key supplier suddenly goes out of business, and the new supplier costs 30% more?

With a clearer understanding of the impacts different situations can present, strategic targets can be set and met.

How to Incorporate Scenario Planning Into Your Budget Process

Introducing scenario planning into your budget process may initially appear daunting. Obviously, you can’t account for every potential scenario.

Instead, scenario planning should be approached like all other parts of your budget – using the knowledge of past business performances and your strategic plans for the future of the organization.

Understand the Business Drivers

The scenarios you choose should have the largest impact on your business if they deviate from your budget.

- Does your team have the right skills to execute your strategic goals, or will you need to hire new resources?

- Are you highly dependent on a partner whose own financials have been volatile in the past?

- If tariffs increase, will you lose business or profits?

- If a competitor goes to market before you do, have you allocated enough resources to out-market and out-sell them?

List both the obvious and the unexpected drivers since the goal is to minimize surprises to your strategic plans and prevent you from exceeding your approved budget.

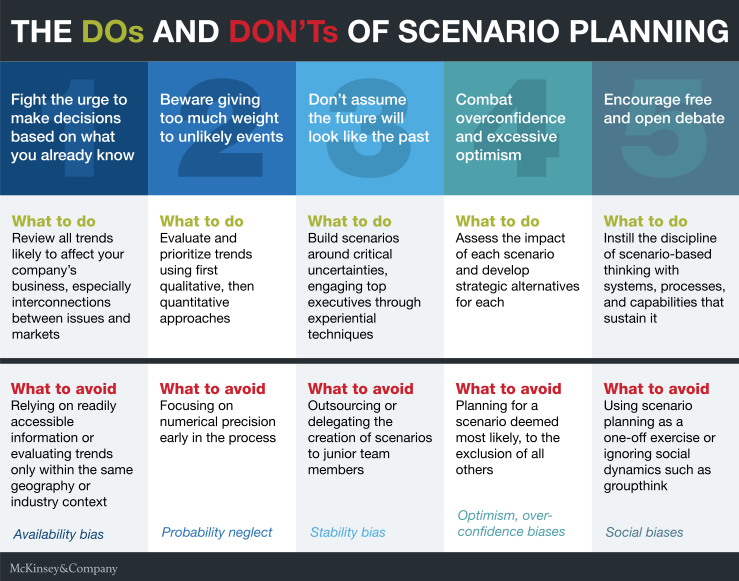

Below, McKinsey & Company’s “Overcoming Obstacles to Effective Scenario Planning” warns against common pitfalls in scenario planning, such as giving too much weight to unlikely events and assuming the future will look like the past.

The chart outlines what you should focus on while scenario planning and what to avoid for best results. Scenario planning can be a complicated process and you should think about various possible outcomes to a situation.

Identify the Biggest Questions

Once you have the list of the key business drivers that can impact your business performance, identify the ones that can wreak the most havoc.

Look closely at the business areas with the most influence on your success or failure. While there are many variables for a business, some will have a more profound impact on your organization, plans, and budget.

Define a Range of Scenarios

Once you have a short list of your biggest questions, develop a range of potential situations.

- What if you aren’t able to find resources with the right skills until months after you need them? What if you find them before you’ve budgeted for new hires?

- How will your partner getting bought out impact your plans? What if they scale back operations? What if they go out of business?

- How dependent are your plans on the success of your new product? How much budget can you reallocate to marketing to beat your competitors? What if the product flops?

Understanding the range of possibilities can point you toward the right strategic decisions while answering important questions you may not think to ask until it’s too late.

Leverage Tools that Make Scenario Planning Easy

If you are still using spreadsheets for budgeting, scenario planning can be difficult. Spreadsheets don’t have the inherent flexibility or functionality needed to change budget values.

This is where FP&A software outshines other budgeting tools. The right financial planning software has the ability to rapidly create scenarios, empowering businesses to make decisions after viewing multiple potentials that could influence success.

For example, the Centage Maestro Suite turns an initial budget into a critical, year-round what-if scenario planning resource for decision-makers by making it easy to modify drivers, revenue, expenses, and payroll assumptions and facilitate comparative analysis of various scenarios.

Below, the Centage Maestro Suite demonstrates how an effective dashboard can organize your budgeting information.

The budgeting tool provides greater insights into your net revenue stream and costs. These features allow you to better plan for your next project.

Keep a Close Eye on Key Drivers

Once an organization’s budget is finalized, keep a close eye on the business drivers that you have used to develop alternative scenarios. If your key drivers begin to veer away from your projections, the actions determined as part of your scenario planning can be used to keep the business on track.

Past performance may only paint part of the picture for your business as you set new goals. Changes in today’s business world happen quickly, and organizations must be prepared to be flexible and act accordingly. Scenario planning is the budgeting tool that allows businesses to plan for the unexpected and adapt when faced with a changing market and environment.