7 Mobile Payment Solutions for Your Small Businesses

7 Mobile Payment Solutions for Your Small Businesses

Many small businesses would benefit from accepting mobile payments. But what solutions are out there, and how do you choose the right one? This article will provide guidance for choosing the best mobile payment solution for your business.

The old idiom “Cash is king” is quickly becoming obsolete in today’s digital society. Nowadays, many people regularly do not carry cash, and cash can’t be sent online or via a mobile phone.

Small business owners should invest in mobile payment solutions to stay relevant for tech-oriented customers. From chip cards to Apple Pay, customers expect you to have the right equipment to accept their preferred method of payment.

Which mobile payment companies and solutions are right for your business? In this article, we explore 7 options for accepting mobile payments from your customers:

- PayPal Here

- Square

- Stripe

- Shopify POS

- Flint

- QuickBooks GoPayment

- PaySimple

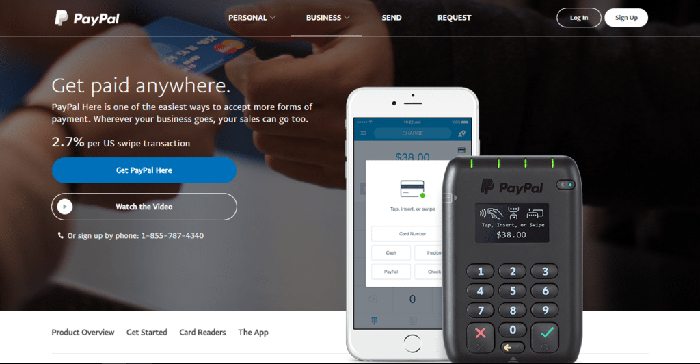

PayPal Here

PayPal has become the industry standard for accepting online payments. PayPal Here is a mobile app for retailers and merchants to process transactions through a smartphone-connected card reader device.

PayPal Here is a logical mobile payment solution for any business that already uses PayPal to accept online payments. PayPal Here has two device options. The Mobile Card Reader supports debit and credit card payments only. The card reader connects via the smartphone audio jack.

The Chip Card Reader supports multiple payments methods—magnetic stripe debit and credit cards, chip cards and Apple Pay. The payment device connects to a smartphone via bluetooth.

The rates and fees for PayPal Here are:

- Swiped transactions: 2.7%

- Keyed-in or scanned transactions: 3.5% + $0.15

- PayPal transactions: 2.7%

- Cross-border transactions, swiped and PayPal: 3.7%

- Cross-border transactions, keyed in or scanned: 4.5% + $0.15

PayPal Here does not require any monthly or annual fees, PCI compliance fees, setup fees, or equipment fees.

Pros

- Consumer confidence

- Flat-rate pricing

- Ideal for low-volume users

- Chip card enabled

- Compatibility with many devices

- Invoices available within the app

- Free multiple sub-accounts

Cons

- Reports of account instability and customer support issues

- $20 chargeback fee

- Transactions cannot be made offline

Square

The Square reader is one of the most recognizable and popular mobile payment solutions.

Square is known for low and simple fees, a free and easy-to-set-up reader, and funding as fast as one day. Square is a good choice for small businesses who need a quick, affordable, and user-friendly way to accept credit card payments on the go.

Square accepts all major credit cards, including American Express, and works on iPhone, iPad, and Android mobile devices. Those who have newer iOS devices without a headphone jack can purchase a Lightning port adapter for an additional $15.

While the basic Square swipe card reader is free, there are several upgraded reader options. To accept chip card payments, you can upgrade to the $29 reader. For “contactless” payments, like Apple Pay or Google Pay, you can purchase a $49 reader. For $129, you can purchase the deluxe Square three-in-one, Bluetooth-enabled, battery-powered reader to accept all credit card payment types from just about anywhere.

The rates and fees for Square are:

- Standard swiped transactions: 2.75%

- Square Register swiped transactions: 2.5% + $0.10

- Keyed-in, Card on File and Virtual Terminal transactions: 3.5% + $0.15

- E-commerce transactions, Invoices: 2.9% + $0.30

There are no monthly or other program fees, including chargeback fees. Square also offers a chargeback protection program that covers the costs of eligible chargebacks, up to $250 per month, even if you don’t win the claim.

Pros

- Flat-rate pricing & no monthly fees

- Ideal for low-volume users

- Impressive amount of features

- Low-cost chip card reader available

- All inclusive payment system

- Toolkit for online sales

Cons

- Reports of sudden account terminations

- Complaints of funds holding

- Customer support issues

- Data not automatically exported to accounting software (e.g., Quickbooks)

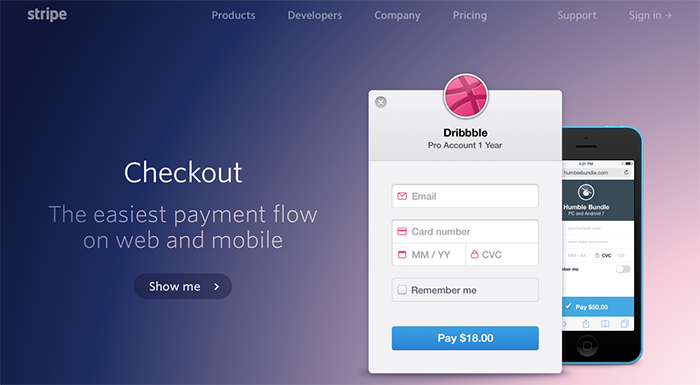

Stripe

Stripe is a third-party payments processor designed to make it easy for companies to do business online. Stripe allows businesses to accept credit card payments, but the company prefers to tout its developer tools.

Stripe’s developer features are industry-leading. The platform is used for subscription billing by numerous software-as-a-service businesses, as well as online retailers looking to power in-app payments. Its feature list is impressive, if a tad overwhelming for the uninitiated.

While Stripe is a solid option to accept mobile payments or create basic subscription billing options, its bells and whistles are meant for larger enterprises. One caveat is that your business will need a developer either on staff or on retainer to take advantage of all of Stripe’s features.

Stripe offers a simple, pay-as-you-go, flat rate pricing structure:

- Credit card transactions: 2.9% + $0.30

Pros

- Highly-rated developer tools

- Flat-rate pricing

- Advanced reporting tools

- Ideal for businesses who sell to international customers

- Excellent marketplace & subscription tools

- Multi-currency support

Cons

- Account stability issues

- No phone support

- May be too advanced for lower transaction volume businesses

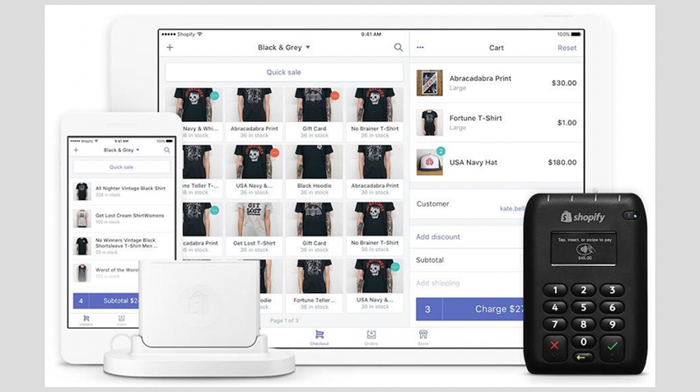

Shopify POS

Shopify is currently one of the most popular online sales platforms, having been a major player in the e-commerce industry since 2005. Shopify POS offers a tiered pricing structure, intuitive design, and dedicated customer support system. Like its parent software, the Shopify POS app is easy to navigate, easy to set up, and easy to use.

Shopify POS is designed specifically for retail, which makes it a good choice for some—but not all—small businesses.

Shopify’s pricing structure is not the simplest among mobile payment companies. Each plan comes with different credit card rates, features, and add-ons. There are four basic pricing options for small businesses:

Lite Plan ($9/month)

- No online store

- In-person credit card rate of 2.7%

- Unlimited products & devices

- 24/7 support

Basic Shopify Plan ($29/month)

- Online store

- In-person credit card rate of 2.7%

- Online credit card rate of 2.9% + $0.30

- External payment gateways rate of 2.0%

- 2 staff accounts

- Unlimited products & devices

- 24/7 support

- Facebook, Pinterest, and Twitter sales channels

Shopify Plan ($79/month)

- Online store

- In-person credit card rate of 2.5%

- Online credit card rate of 2.6% + $0.30

- External payment gateways rate of 1.0%

- 5 staff accounts

- Unlimited products & devices

- 24/7 support

- Facebook, Pinterest, and Twitter sales channels

- Professional reports

- Abandoned cart recovery

Advanced Shopify Plan ($299/month)

- Online store

- In-person credit card rate of 2.4%

- Online credit card rate of 2.4% + $0.30

- External payment gateways rate of 0.5%

- 15 staff accounts

- Unlimited products & devices

- 24/7 support

- Facebook, Pinterest, and Twitter sales channels

- Gift cards

- Professional reports

- Advanced report builder

- Third-party calculated shipping rates

Shopify POS offers a free chip and swipe reader, while other hardware bundles are available for a fee.

Pros

- Reasonably priced

- Excellent customer service

- Robust reporting and CRM features

- Intuitive interface

- Syncs instantly with Shopify e-commerce

Cons

- Excessive credit card transaction fees

- No employee management (permissions, time clock, etc.)

- Some inventory features lacking

- Cannot issue store credit to customers

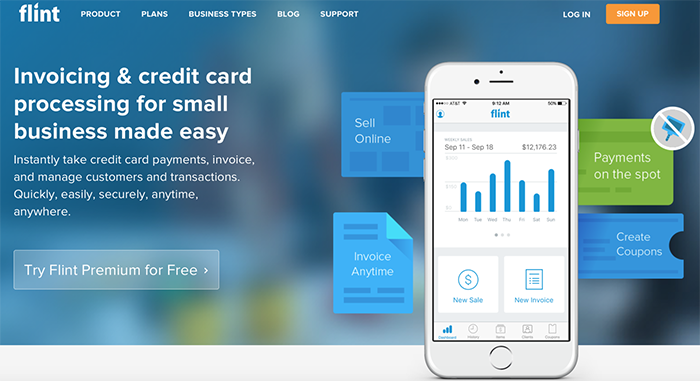

Flint

Flint is a unique mobile payment solution for small businesses. Flint forgoes the card reader that plugs into your smartphone or tablet. Flint instead uses a scanner based on your smart device’s camera. It captures the card number and expiration date with no need for any extra equipment.

All Flint sales are technically processed as “Card Not Present” (or CNP) transactions. This eliminates the liability of swiping fraudulent chip cards. However, CNP transactions are generally a higher risk than swiped transactions.

Flint’s rates are on par with most other pay-as-you-go e-commerce options: 2.9% + $0.30 per transaction. On top of the rate for payment processing, Flint offers 3 monthly plans for businesses:

Free Plan

- Unlimited mobile point of sale (mPOS) processing

- 10 invoices per year

- 10 clients in client database

- 1 user

- No online sales

Pro Plan ($99.99/year or $9.99/month)

- Unlimited mPOS processing

- Unlimited invoices per year

- 50 clients in client database

- 4 users (owner + 3)

- Unlimited online sales

Enterprise Plan ($149.99/year or $14.99/month)

- Unlimited mPOS processing

- Unlimited invoices per year

- Unlimited clients in client database

- 6 users (owner + 5)

Pros

- Requires no hardware

- Predictable flat-rate pricing

- In-app invoicing

- No monthly minimums

Cons

- Expensive pricing

- Limited features

- Account stability issues

- No phone support

- Limited support materials

QuickBooks GoPayment

QuickBooks GoPayment is Intuit’s mobile payment solution that syncs sales directly to your QuickBooks Online or desktop software. If your business already uses QuickBooks, using GoPayment for your mobile payment processing will integrate seamlessly with your accounting software.

Unlike other mobile payment companies, Intuit requires you to open a merchant account in order to use GoPayment. This adds stability to the service, decreasing holds and freezes, while giving access to the full suite of services QuickBooks Payments provides.

Intuit offers a choice of two service plans: Pay-As-You-Go and Monthly. The former has no monthly fee and higher rates, while the latter has a monthly fee but lower processing rates:

Pay-As-You-Go

- No monthly fee

- 2.4% + $0.25 per swiped/dipped transaction

- 3.4% + $0.25 per keyed transaction

Monthly Plan

- $20 monthly fee

- 1.6% + $0.25 per swiped/dipped transaction

- 3.2% + $0.25 per keyed transaction

The retail price for GoPayment’s chip and magstripe reader is $19, but that fee is waived for new GoPayment merchants. Intuit also plans to release an “all-in-one” reader with support for wireless (e.g., Apple Pay, Android Pay) transactions. The all-in-one device is expected to cost around $50.

Pros

- QuickBooks Online integration

- Predictable flat-rate pricing

- Solid feature set

- Affordable chip card readers

- Free sub-user accounts

Cons

- Inconsistent customer support

- High per-transaction fees

- Users say the app is buggy at times

- Not suitable for new businesses and individuals

PaySimple

PaySimple provides payment options for businesses. PaySimple allows you to accept credit and debit cards as well as e-checks from one system. It also gives users the ability to create invoices, email invoices to customers, and offer multiple payment options through a secure portal.

In the process of signing up for the PaySimple platform, you are assigned a dedicated merchant account with a separate processor on the back end. In this sense, PaySimple combines a mobile payment solution with a traditional merchant services provider (MSP). This is a great solution if you want to take advantage of advanced billing features but aren’t necessarily tech-savvy.

According to its customers, PaySimple excels in customer service and support. Whether you need assistance or training, the support team is there every step of the way.

PaySimple offers two types of plans, Pro and Enterprise, with the following pricing structure:

Pro Plan

- Platform fee $49.95/month

Credit & Debit Rates

- Qualified Rate: 2.49% + $0.29

- Mid-Qualified Rate (Personal Rewards Cards): 2.60% + $0.29

- Non-Qualified Rate (Corporate Cards): 3.69% + $0.29

- (Ultra) Non-Qualified Rate (Corporate Rewards Cards): 3.80% + $0.29

Credit & Debit Fees

- On-File Fee: $5/month

- PCI Fee: $4.95/month

- PCI Non-Compliance (if applicable): $24.95/month

- Batch Fee: $0.29

- Chargeback Fee: $25

ACH (eCheck) Rates & Fees

- Processing Rate, < $5K/month: 0.10% + $0.60

- Processing Rate, > $5K/month: $0.60

- High Ticket Surcharge (above $5K ticket): 0.25%

- Monthly Minimum Fee: $5.00

- Batch Fee: $0.60

- Chargeback Fee: $25

- Return Fee: $5

The Enterprise plan has a platform fee of $99.95/month. Additional features beyond the Pro package are:

- Customized processing rates

- Dedicated account manager

- API integration

- Multi-location support

The PaySimple credit card reader costs $29.95. The device plugs into the headphone jack of any iOS or Android device and syncs with the PaySimple mobile app.

Pros

- Ideal for service industries

- No early termination fee

- No setup or application fees

- Good subscription & invoicing tools

- Customizable payment pages

- eCheck processing offered

- Excellent customer support

Cons

- Not good for high-volume, card-present merchants

- Not good for international merchants

- Account stability issues

Finding the Right Fit

For small businesses, adopting a mobile payment solution can increase cash flow while improving efficiency and customer service.

There are a number of mobile payment solutions available, and each one has nuances that may make it more, or less, attractive to a business owner. You will need to research the various options carefully, as well as read all of the fine print, before choosing the right mobile payment solution for your small business.